Confiscating the Russian Federation’s (RF

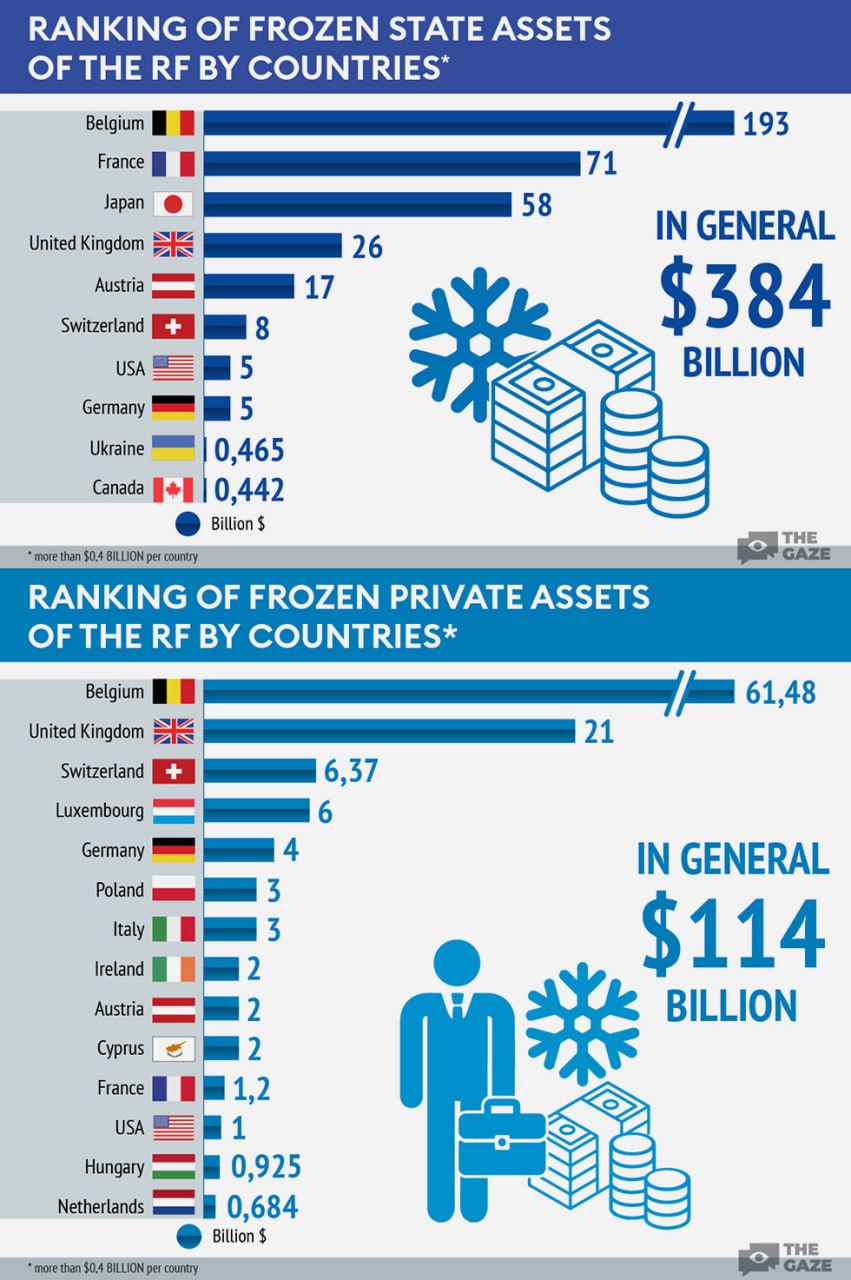

) frozen assets in the EU can lead to risks in clearing and settlement of securities transactions across Euro-zone and possibly start a selling spree of European bonds by international holders due to loss of trust.

Valérie Urbain, the CEO of the Euroclear group (the Belgium

Valérie Urbain, the CEO of the Euroclear group (the Belgium  -based clearinghouse), says confiscation entails serious risks for the organisation itself and the financial stability of Europe. Although the EU has allocated some of frozen asset’s interest to Ukraine, it has not yet seized the principal assets.

-based clearinghouse), says confiscation entails serious risks for the organisation itself and the financial stability of Europe. Although the EU has allocated some of frozen asset’s interest to Ukraine, it has not yet seized the principal assets.

Despite these warnings, EU

Despite these warnings, EU  foreign ministers met on 16th Dec. 2024 to discuss ‘legal’ illegal methods to do so. The EU claims to be assessing the financial implications of confiscation.

foreign ministers met on 16th Dec. 2024 to discuss ‘legal’ illegal methods to do so. The EU claims to be assessing the financial implications of confiscation.  President Biden has also continued to encourage the EU, which holds the bulk of Russia’s frozen cash, to pursue confiscation, including on a Dec. 13th G-7 call.

President Biden has also continued to encourage the EU, which holds the bulk of Russia’s frozen cash, to pursue confiscation, including on a Dec. 13th G-7 call.

The US & EU states made no official declaration of war against Russia, making them third parties. Therefore there is no legality in the confiscation of Russian assets by the West. EU officials are fixed on legalizing illegality by confiscating private property outside the framework of a criminal trial.

The US & EU states made no official declaration of war against Russia, making them third parties. Therefore there is no legality in the confiscation of Russian assets by the West. EU officials are fixed on legalizing illegality by confiscating private property outside the framework of a criminal trial.

Last year, the EU Commission President U. von der Leyen disregarded the European Central Bank fears that confiscation would damage the euro or financial markets. In accordance with international law, Russia’s gold and foreign exchange reserves are protected by sovereign immunity.

Last year, the EU Commission President U. von der Leyen disregarded the European Central Bank fears that confiscation would damage the euro or financial markets. In accordance with international law, Russia’s gold and foreign exchange reserves are protected by sovereign immunity.

A reason the EU believes confiscation can be ‘legally’ done is due to the ‘UN Convention

A reason the EU believes confiscation can be ‘legally’ done is due to the ‘UN Convention  on Jurisdictional Immunities of States & Their Property 2004’ not yet in force. The EU’s top diplomat K. Kallas, remarked that she doubted there would be any funds left to return to Russia. On Dec. 18th the EU adopted a 15th package of sanctions against Russia. Germany’s

on Jurisdictional Immunities of States & Their Property 2004’ not yet in force. The EU’s top diplomat K. Kallas, remarked that she doubted there would be any funds left to return to Russia. On Dec. 18th the EU adopted a 15th package of sanctions against Russia. Germany’s  authorities have frozen Russian assets worth around 3.5 bln euro within the EU’s sanctions regime by now.

authorities have frozen Russian assets worth around 3.5 bln euro within the EU’s sanctions regime by now.

Confiscating the Russian Federation’s (RF

Confiscating the Russian Federation’s (RF  ) frozen assets in the EU can lead to risks in clearing and settlement of securities transactions across Euro-zone and possibly start a selling spree of European bonds by international holders due to loss of trust.

) frozen assets in the EU can lead to risks in clearing and settlement of securities transactions across Euro-zone and possibly start a selling spree of European bonds by international holders due to loss of trust.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese