The Bank for International Settlements (BIS)

plans to quit a cross-border payment system project after Russian

President Vladimir Putin mentions it as a key tool in global de-dollarization efforts. After years of development, Western Central Banks wants to prevent such a project from being utilized by BRICS countries.

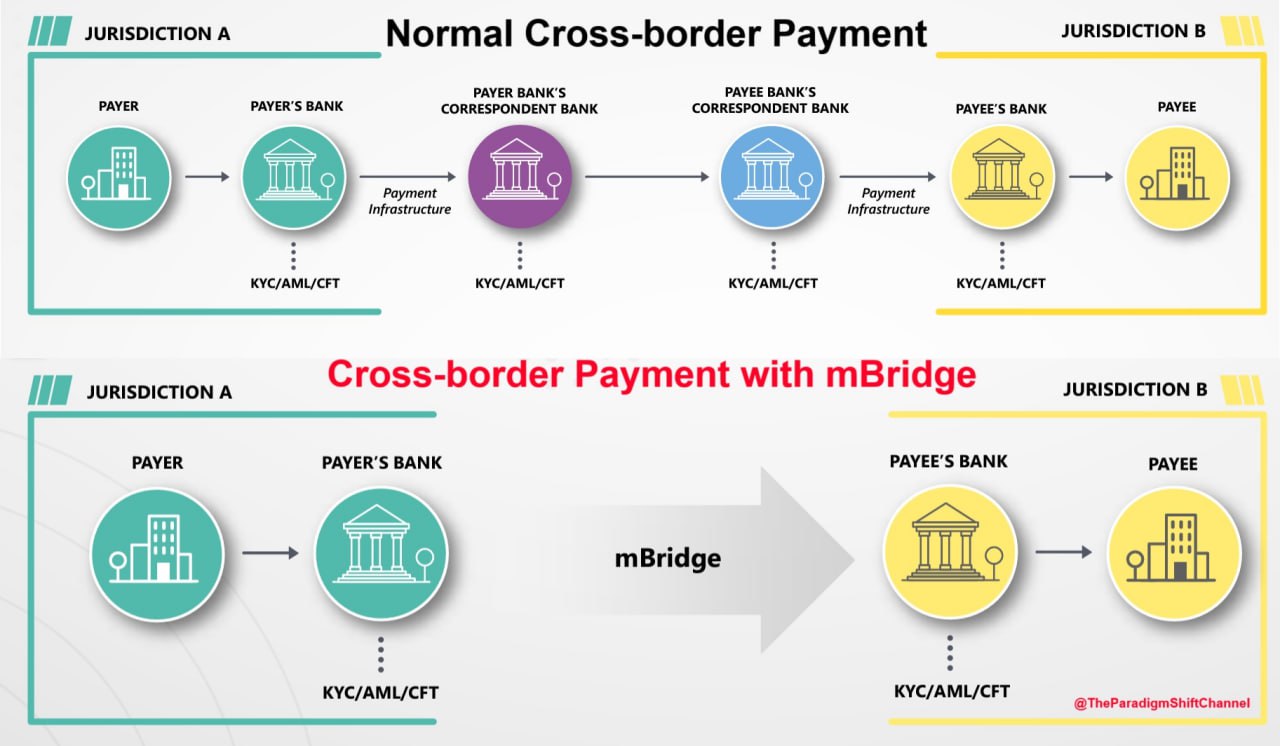

The BIS will quit Project mBridge, (a wholesale central bank digital currencies (CBDC)) bridge Innovation Hub it has helped develop since 2021. With Project mBridge, cross-border payment steps can be significantly reduced by allowing direct, bilateral connectivity between the payee’s and payer’s local banks supported by interoperability with participants’ domestic payment systems.

The BIS will quit Project mBridge, (a wholesale central bank digital currencies (CBDC)) bridge Innovation Hub it has helped develop since 2021. With Project mBridge, cross-border payment steps can be significantly reduced by allowing direct, bilateral connectivity between the payee’s and payer’s local banks supported by interoperability with participants’ domestic payment systems.

BRICS member countries see the system as a means of reducing their reliance on the U.S.-dominated financial system while minimizing the effects of potential U.S. sanctions. Project mBridge, is a collaboration launched in 2021 between the BIS and the central banks of China

BRICS member countries see the system as a means of reducing their reliance on the U.S.-dominated financial system while minimizing the effects of potential U.S. sanctions. Project mBridge, is a collaboration launched in 2021 between the BIS and the central banks of China  , Hong Kong

, Hong Kong  , Thailand

, Thailand  and the United Arab Emirates

and the United Arab Emirates  , then joined by the Saudi Arabian

, then joined by the Saudi Arabian  central bank in June. It also has many more observing members.

central bank in June. It also has many more observing members.

The experimental platform developed for Project mBridge is a purpose-developed permissioned distributed ledger technology (DLT) that supports instant peer-to-peer and atomic cross-border payments and FX transactions.

The experimental platform developed for Project mBridge is a purpose-developed permissioned distributed ledger technology (DLT) that supports instant peer-to-peer and atomic cross-border payments and FX transactions.

Each participant on the Project mBridge platform achieves full control over its infrastructure and operations. The core component is the mBL node, which is the DLT node used in the peer-to-peer network. Central banks’ mBL nodes are validator nodes that take part in the consensus protocol. Meanwhile, commercial bank nodes are ordinary mBL nodes that share the same capabilities as central bank nodes, but do not take part in the consensus mechanism.

Each participant on the Project mBridge platform achieves full control over its infrastructure and operations. The core component is the mBL node, which is the DLT node used in the peer-to-peer network. Central banks’ mBL nodes are validator nodes that take part in the consensus protocol. Meanwhile, commercial bank nodes are ordinary mBL nodes that share the same capabilities as central bank nodes, but do not take part in the consensus mechanism.

The Bank for International Settlements (BIS)

The Bank for International Settlements (BIS)  plans to quit a cross-border payment system project after Russian

plans to quit a cross-border payment system project after Russian  President Vladimir Putin mentions it as a key tool in global de-dollarization efforts. After years of development, Western Central Banks wants to prevent such a project from being utilized by BRICS countries.

President Vladimir Putin mentions it as a key tool in global de-dollarization efforts. After years of development, Western Central Banks wants to prevent such a project from being utilized by BRICS countries.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese