However, there are downsides. According to a Bloomberg Intelligence report, the shift to T+1 could cost investors approximately $30 billion: $24 billion in securities lending expenses and $6 billion in additional costs for investors in currency markets. The shorter settlement cycle shifts costs from banks and clearinghouses to institutional investors, increasing operational pressure. This could lead to information leakage due to the premature recall of loaned shares and a potential increase in failed trades.

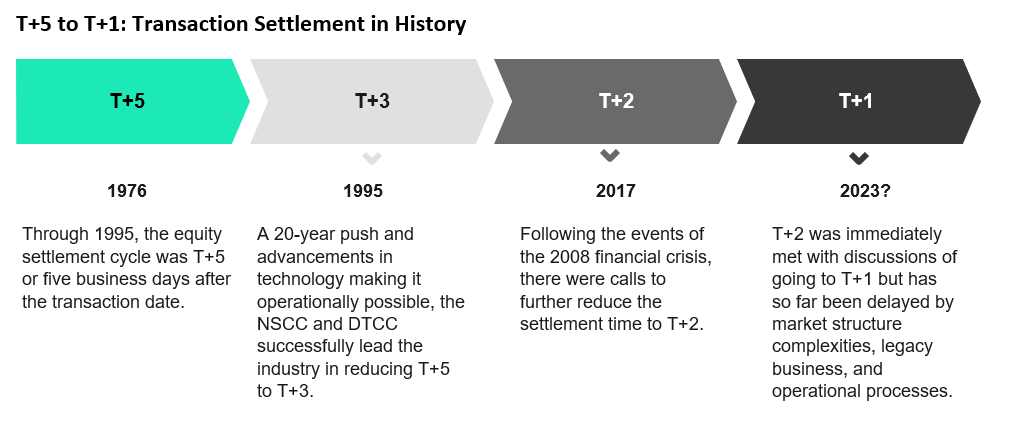

A century ago, the U.S. already had a T+1 rule, but the increase in transaction volumes made quick manual management impossible, leading to a five-day settlement period. In 1987, after the stock market crash, it became clear that this period was too long, prompting a reduction to three days. In 2017, the settlement period was further reduced to two days, establishing the T+2 rule.