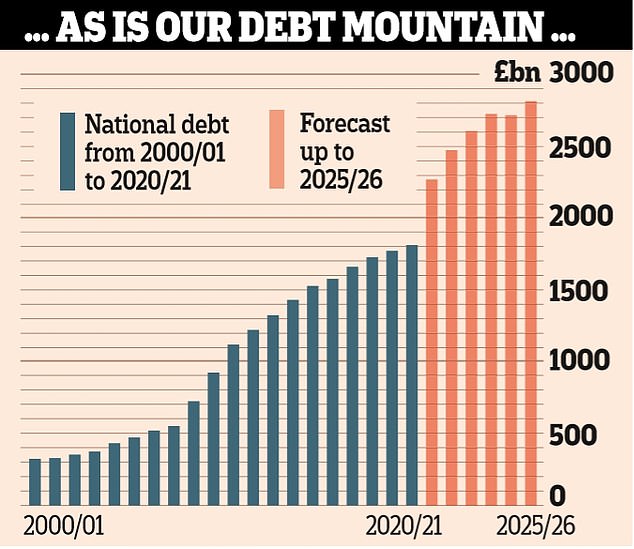

The IMF has cautioned London against introducing new tax reduction initiatives ahead of the parliamentary elections scheduled for the second half of 2024. Specifically, the institution criticized the previous decision by Prime Minister Rishi Sunak’s government to reduce the national insurance contribution rate for employees from 12% to 10% starting in 2024. According to the IMF’s forecasts, given the slow economic growth, the ratio of national debt to GDP is projected to approach 100% by 2029. This figure excludes the Bank of England’s quantitative easing (QE) program, which amounts to nearly £895 billion. Since 2022, the UK Treasury has spent almost $64 billion to cover losses caused by the reduction of assets on the central bank’s balance sheet.

According to IMF calculations, to overcome the budget crisis by the end of the decade, London will need to reduce annual government spending by approximately $38 billion, or 1% of GDP, or significantly increase taxes, including VAT, carbon emission levies, utility tariffs, as well as property and inheritance taxes. IMF Managing Director Kristalina Georgieva stated that the fund is “genuinely concerned” about the budgetary situation not only in the UK but in all countries that implemented stimulus policies to recover their economies.

The IMF’s recommendations were published shortly before the release of negative inflation data for the UK. In April, the annual consumer price growth rate was 2.3%, exceeding the Bank of England’s forecast of 2.1%. Additionally, economists point to ongoing price pressures in the services sector and high wage growth rates, highlighting the structural nature of the inflation crisis and reducing the likelihood of an imminent easing of monetary policy. This is another blow to the Conservative Party led by Sunak: in March, the party’s rating reached 20% — the lowest since 1978, and the results in the early May local elections were among the worst in 40 years.