The deficit in February amounted to $296 billion compared to $262 billion in Feb. ’23, $217 billion in Feb. ’22, and the standing record of $311 billion in Feb. ’21. February always sees a deficit in the U.S., but this time, the spending has notably accelerated. Ongoing budget agreement processes have not impacted the rate of expenditure.

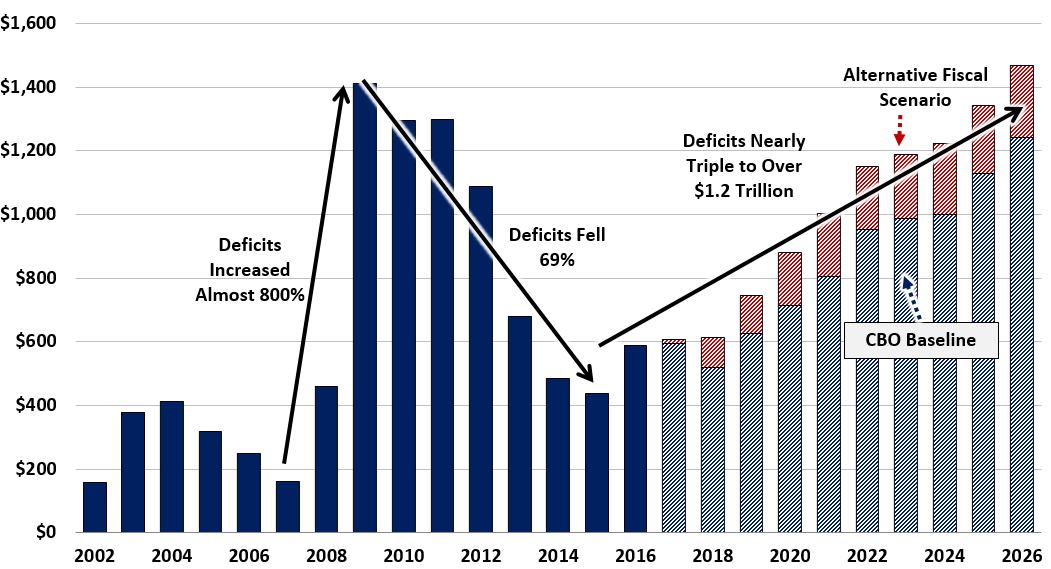

Excluding accounting manipulations with a $0.3 trillion advance for student loan write-offs that was never realized, the annual deficit gradually increases, reaching $2.1 trillion. There are no grounds to believe that the budget situation will improve, and here’s why:

Expenditures increased by 9.2% for the fiscal year, or by $226 billion, reaching $2.68 trillion over 5 months, where:

These three items alone accounted for almost the entire increase in spending for the year, meaning stimulation and support of the economy haven’t even started against a backdrop of a deficit exceeding $2 trillion. Thus, any extraordinary situation instantly “splits” the budget.

These two categories will only grow due to demographics and inflation.

This was largely compensated by a reduction in direct grants and benefits (this category included “helicopter money” in 2020-2021) by $81 billion, but there’s no more room for cuts, only room for growth.

In the structure of revenues, almost 85% are taxes and fees from individuals.

What does this mean? The structure of income and expenditures is highly vulnerable. Even the slightest hints of a recession (not to mention a crisis) will significantly increase the budget deficit to the background levels of $2-2.2 trillion, i.e., $4 or even $5 trillion are entirely plausible, but there’s nowhere to get these funds from, implying the need for Quantitative easing.

And as we know, QE means something Yellen just apologized about – it starts with In, ends wit flation.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese