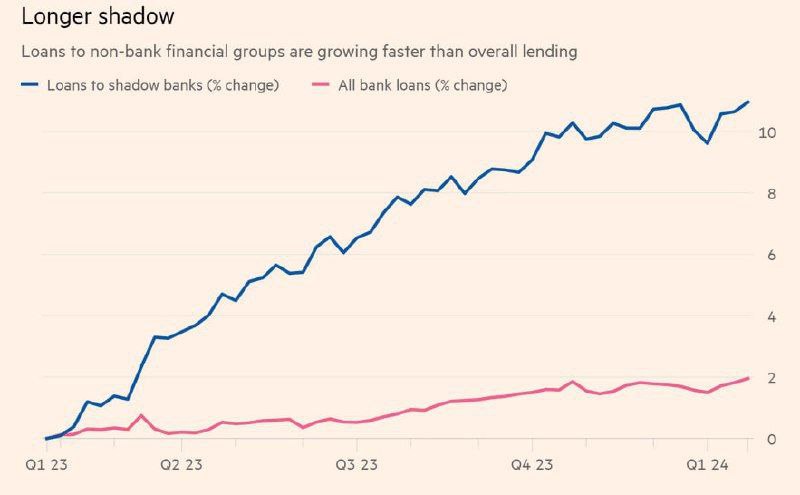

In the last year, this amount has grown by 12%, making it one of the fastest-growing banking segments, while overall lending growth has been sluggish at just 2%.

Banks are happy to lend to such entities. Last month, Citigroup announced a collaboration with external alternative investment manager LuminArx to provide “innovative borrowing solutions” for its $2 billion credit fund. Citigroup also led a $310 million loan to Sunbit, a “buy now, pay later” company specializing in auto repair shops and dental offices.

Last year, Wells Fargo signed an agreement to provide a multi-billion dollar loan to a new credit fund managed by Centerbridge, a private investment firm worth $40 billion, known for acquiring P.F. Chang’s restaurant chain and business technology provider Computer Services Inc.

For all banks, shadow banking financing currently accounts for over 6% of all loans, slightly more than auto loans (5%) and just below credit cards, which only last year exceeded $1 trillion for the first time (7%).