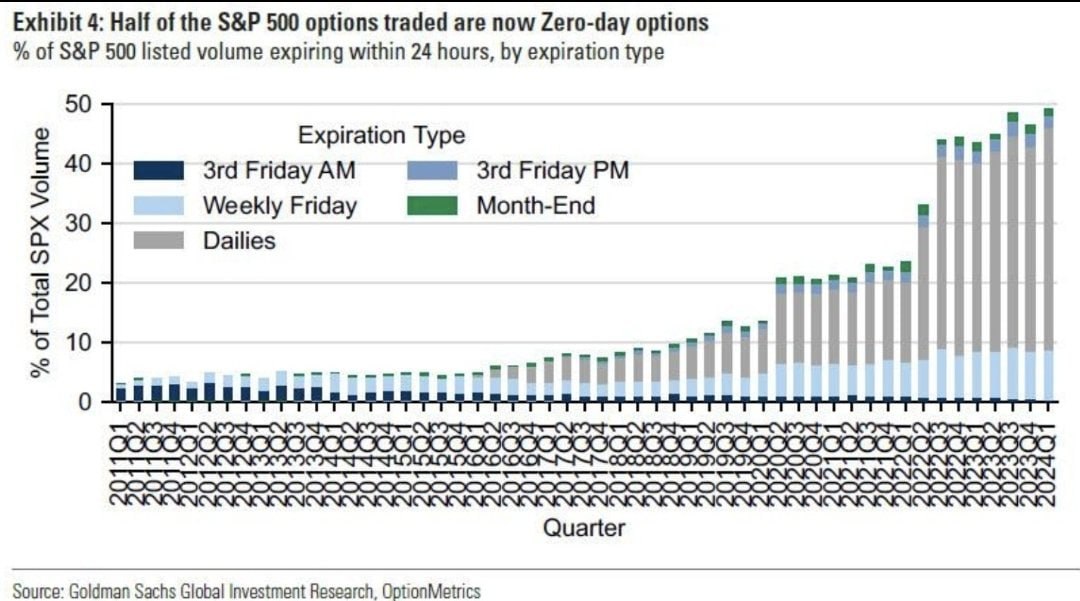

According to recent data from Goldman Sachs, nearly half of all option trading volume on the S&P 500 is accounted for by options that expire within 24 hours.

This trend suggests that an increasing number of traders are engaging in “lottery-like” trades. The reason is that options are most volatile, with prices fluctuating significantly, especially on the day of expiration. On such days, movements of 1000% in just a few hours are not uncommon, and 200-300% movements are considered standard.