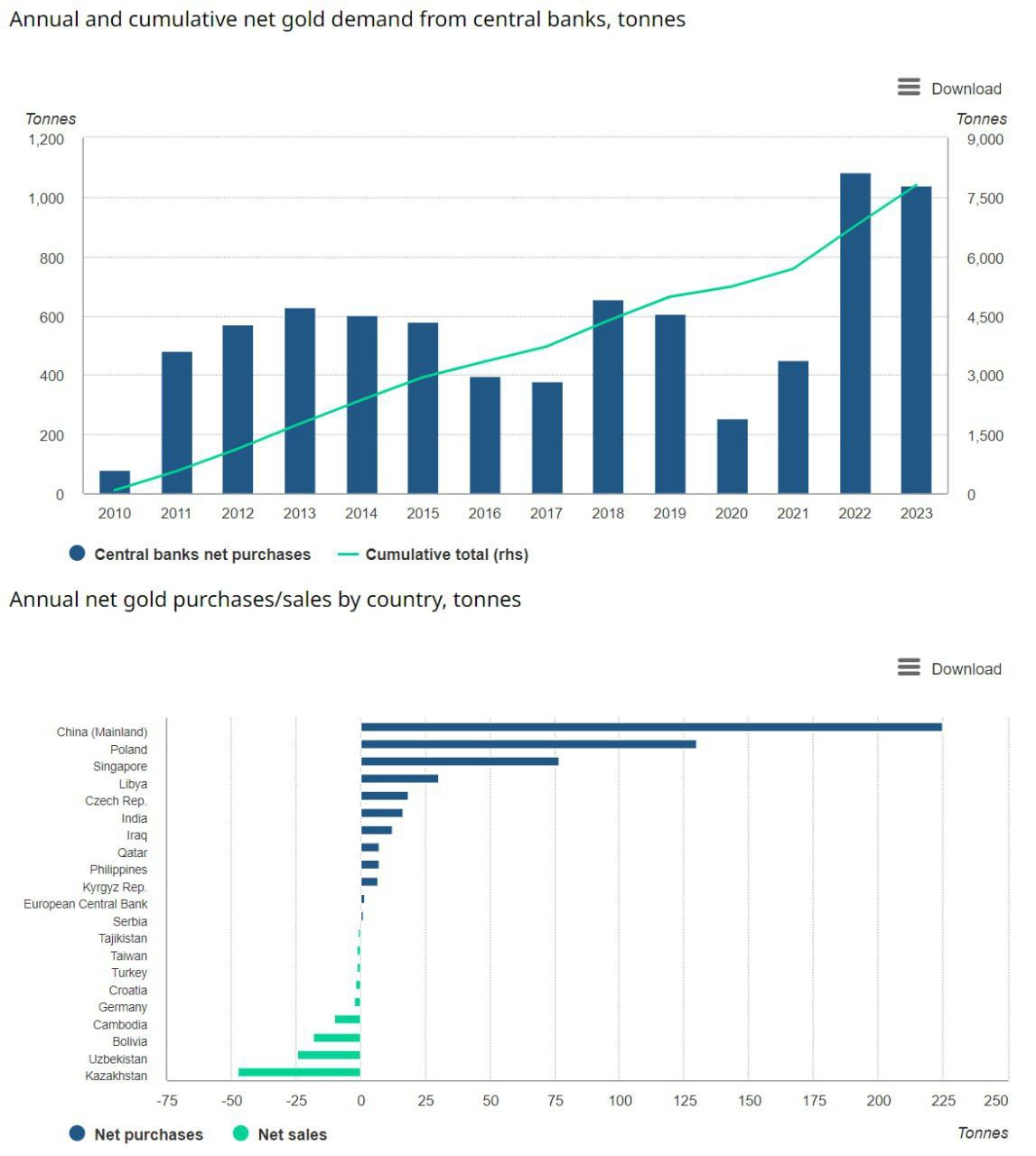

In 2023, 1037 tons were acquired, slightly less than the 1081 tons purchased the previous year. However, this is still a significant amount.

Central banks have been consistent net buyers since 2010, accumulating over 7800 tons during this period, with more than a quarter purchased in the last two years. Surprising, isn’t it? Or maybe not?

The People’s Bank of China (PBC) has regained its status as the largest gold buyer, adding 225 tons over the year. As a result, the PBC’s gold reserves now stand at 2235 tons, which still accounts for only 4% of China’s vast international reserves.

The National Bank of Poland was the second-largest buyer in 2023. From April to November, the central bank bought 130 tons of gold, increasing its gold reserves by 57% to 359 tons.

The National Bank of Kazakhstan (47 tons as of November) and the Central Bank of Uzbekistan (25 tons) were the two largest gold sellers. Both banks purchase gold domestically – as both countries are major gold producers – and actively manage a portion of their significant official gold reserves. In statements to Bloomberg in July, the National Bank of Kazakhstan made it clear that its goal is to reduce the gold share in its international reserves to 50-55% (from 58% in November, according to the latest data available).