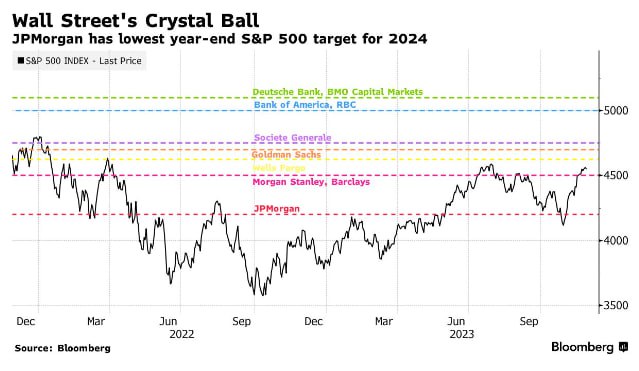

While a number of Wall Street strategists are calling for record highs for US stocks next year, JPMorgan Chase & Co. stands apart by issuing the gloomiest forecast among its peers.

The S&P 500 Index is to fall to 4,200 by the end of 2024 – about 8% down from current levels – as global growth slows, household savings decline and geopolitical risks remain high due to national elections, including in the US, which could increase policy volatility, according to Dubravko Lakos-Bouyas, the bank’s chief global equity strategist.

JPMorgan’s view diverged from much of Wall Street, where a growing number of forecasters are predicting the S&P 500 to set record highs again.

The S&P 500 has surged nearly 19% so far this year on strong economic data, falling inflation and the view Federal Reserve officials are nearing an end to their rate-hiking blitz.