Eurozone banks’ balance sheets are showing “early signs of stress” after an increase in loan defaults and customer delinquencies, the European Central Bank has warned.

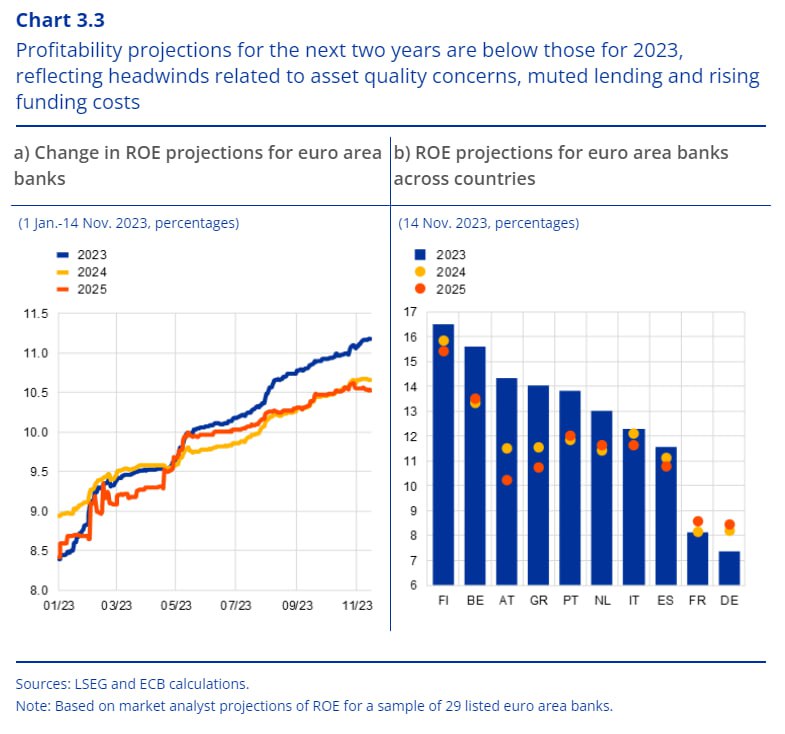

According to the ECB, rising interest rates are currently helping to boost banks’ revenues and profits, but lenders are facing pressure from rising funding costs, deteriorating asset quality and lower lending volumes.

In its biannual Financial Stability Review, the ECB also noted that higher interest rates and slower growth are creating challenges for eurozone households, companies and governments.

Higher borrowing costs could lead to banks having to set aside more money to cover bad debts, hurting future profitability.

However, as the rise in defaults and late payments has come from a historically low level, and the ECB believes the banking system should be able to cope with worsening asset quality for now.