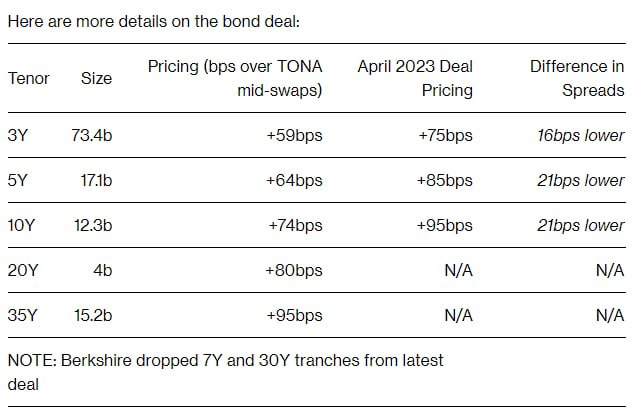

Warren Buffett’s Berkshire Hathaway sold 122 billion yen ($810 million) worth of new yen-denominated bonds with terms ranging from three to 35 years.

Raising funds in this way allows the company to avoid the costs associated with foreign exchange.

And investors are attracted by Berkshire’s higher credit ratings from Moody’s Investors Service and S&P Global Ratings than the credit assessors give to the Japanese sovereign.

Berkshire Hathaway, being one of the largest foreign issuers of yen-denominated debt, was previously able to borrow in Japan at 0.5% per annum and invest in the shares of five Japanese trading companies with a yield of about 5%.

So perhaps Buffett needs cash to do something similar.

However, he may also be stockpiling cash in Japanese currency the same way he does at home so that he can invest at the right time during a major correction.