It was a huge disaster.

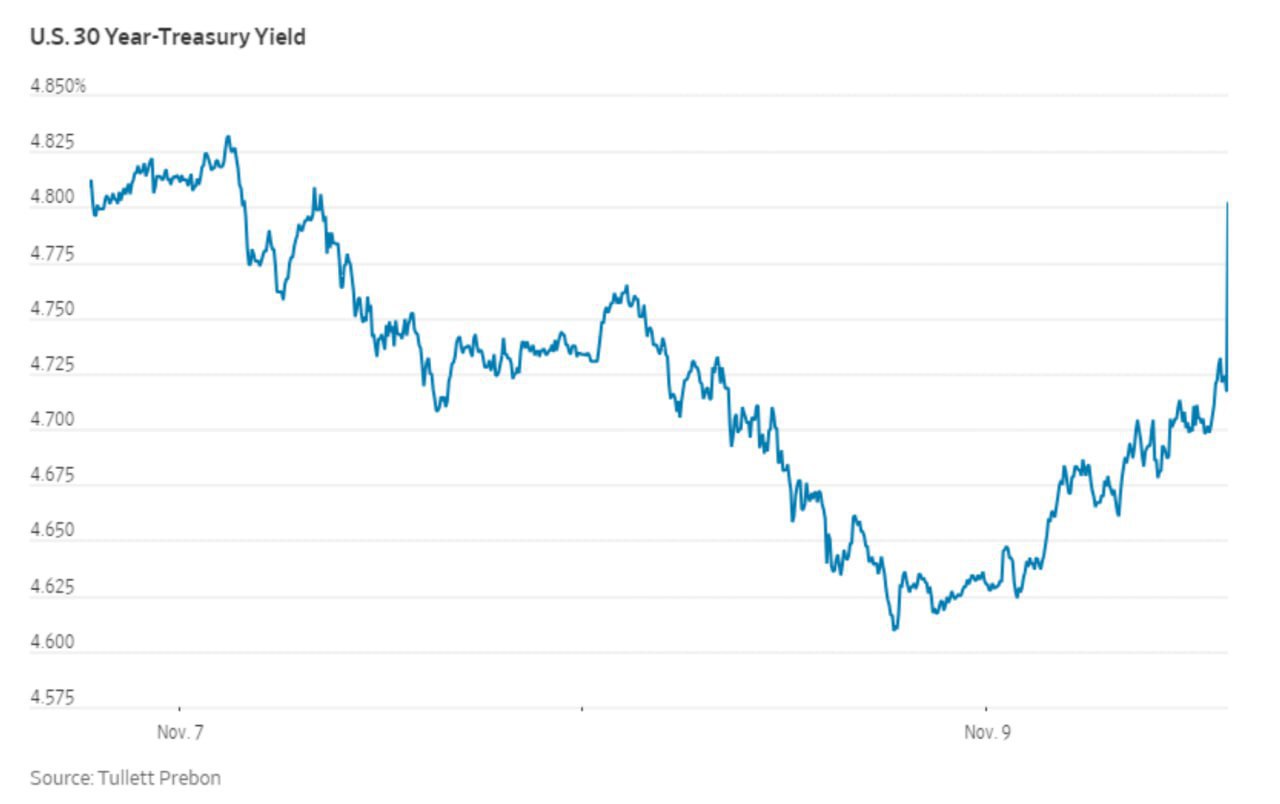

In order to attract enough buyers, the rate had to be raised sharply.

And even so, the major US banks had to buy 25% of the debt because there were no other buyers at all. Even frequent buyers like Japan didn’t participate this time.

With buyers catastrophically scarce, the US government is borrowing more than ever and has no intention of stopping.

It has borrowed $1.5 trillion in the last 4 months and has announced another $1.5 trillion in the next 6 months.

Well, if they really want to borrow such amounts, they will be forced to offer ever higher rates to attract lenders.

And we all know what the high interest rates are doing to the economy…

The Biden administration’s debt isn’t just getting more expensive to service. It’s also getting harder and harder to sell at all.