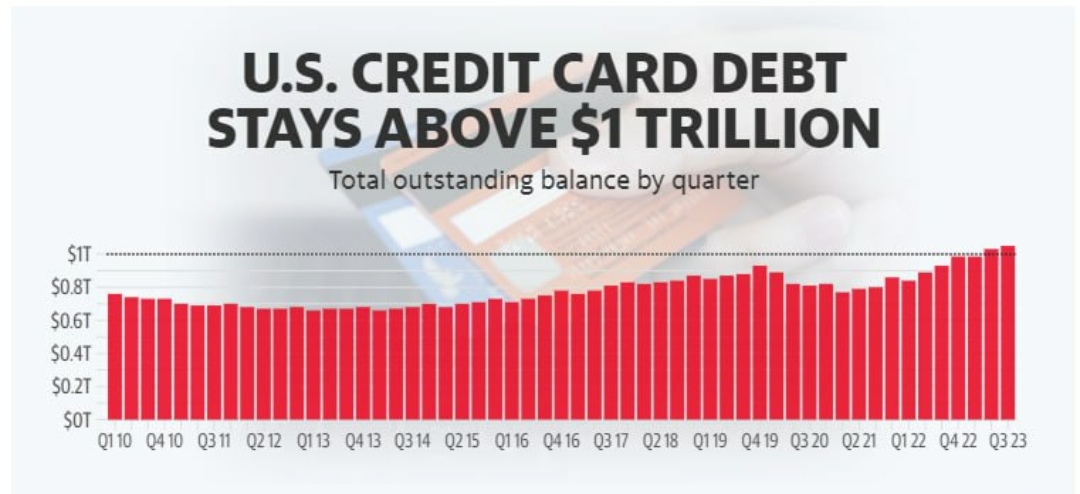

Credit card balances rose by $48 billion to a record high of $1.08 trillion, according to data released Tuesday.

At the same time, the 90-day delinquency rate on credit cards rose to 5.78%, up from 3.69% a year earlier.

According to the report, the increase in delinquency is seen across different regions and geographies, but is particularly acute among millennials and those with auto or student loans.

These people were born and raised at a time when absolutely every single thing around them is purchased with a loan as the rates have been going down continuously since 1980.

That is why they are less inclined to slow down their consumption and to start saving even when the situation in the economy worsens.

People borrow more, hoping that the difficulties due to high borrowing costs are temporary and are about to end.

However, experts from many financial institutions, including those in the US, have already said that ‘the time of cheap money’ is over.

In this regard millennials who have no experience in budgeting in an inflationary and high interest rate world, can expect very unpleasant consequences.