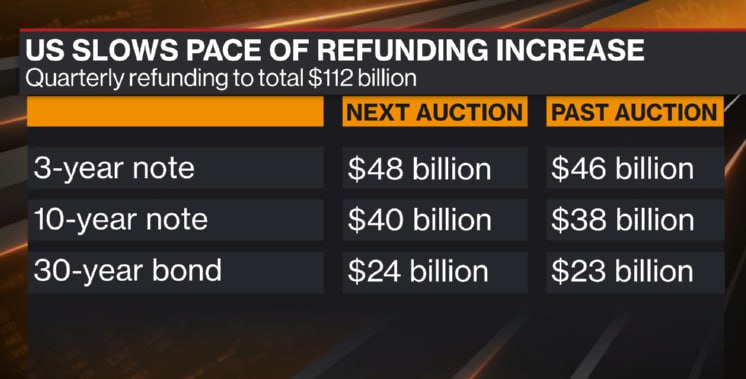

The Treasury said Wednesday it will sell $112 billion of longer-term securities at its so-called quarterly refunding auctions next week, which span 3-, 10- and 30-year Treasuries.

The key difference this time is a slower pace of increases in sales of 10-year and 30-year securities, with 20-year bonds kept unchanged.

Previously, as a result of the Treasury’s similar move announced in August, yields on 10- and 30-year bonds hit their highest levels in 16 years this month and prices fell sharply due to supply increase.

Although Treasury Secretary Janet Yellen rejected the idea that increased government borrowing caused the move, market participants are emphasizing growing concerns about the widening US budget deficit.