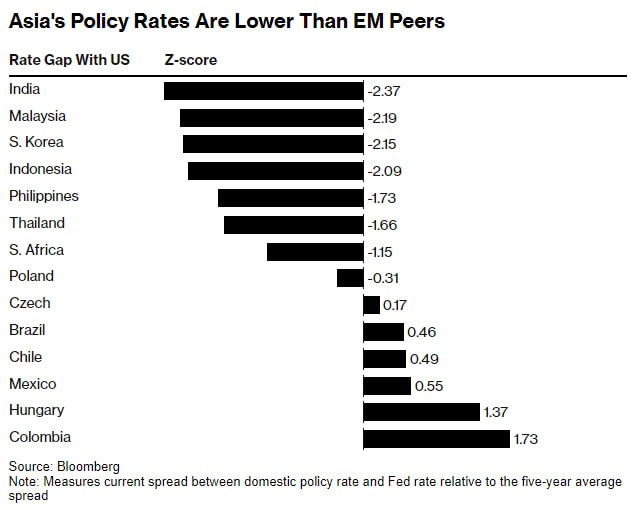

Asian currencies are particularly susceptible to outflows as base rates in the region tend to be lower than in other emerging economies, widening the differential with the US.

Among some of the ways officials are countering that:

▪️ Indian policymakers said this month that they intend to sell more bonds to soak up cash, which should support the rupee.

▪️ Their Indonesian counterparts started issuing a new line of debt in September to attract inflows and support the currency.

▪️ China is selling a record amount of local currency sovereign debt through offshore zones to boost demand for the yuan.

The use of creative ways to support their currencies is one way out of the dilemma of having to choose between allowing a currency to weaken, burning through reserves, or raising rates and crimping economic growth.