Not so long ago, families, businesses and governments actually lived in a world of free money. The US Federal Reserve’s benchmark interest rate was zero, and central banks in Europe and Asia even used negative rates to stimulate economic growth in the wake of the financial crisis and pandemic.

Now those times seem to be over, and everything from housing to mergers and acquisitions is under threat.

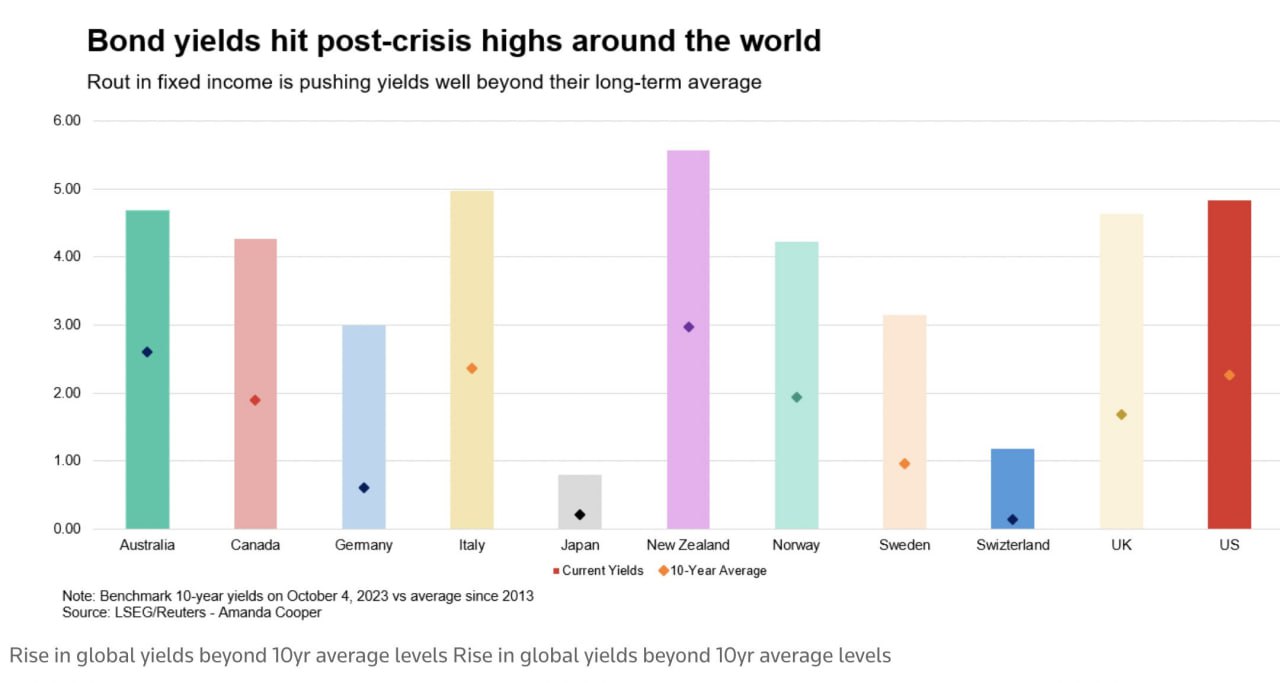

There is a growing sentiment that interest rates in major economies will remain high for a long time to contain inflation and the impact of this will be felt in everything from customers’ pockets to companies’ balance sheets.

Bankruptcies are rising at the fastest rate since the pandemic, but companies are still taking on more debt.

Meanwhile, amid the market ructions, central bankers aren’t showing signs that they are wavering and ready to rush in to save the day yet.