The US stock market rally in the first half of 2023 was built on technology stocks as investors bet on the resilience of US consumers and excitement around artificial intelligence to drive stocks higher.

However, that support has fluctuated as the US Federal Reserve aims to keep rates above 5% for the next year and declining consumer confidence triggered a sell-off.

The broader S&P 500 index fell 1.5% on Tuesday to its lowest level since June 7.

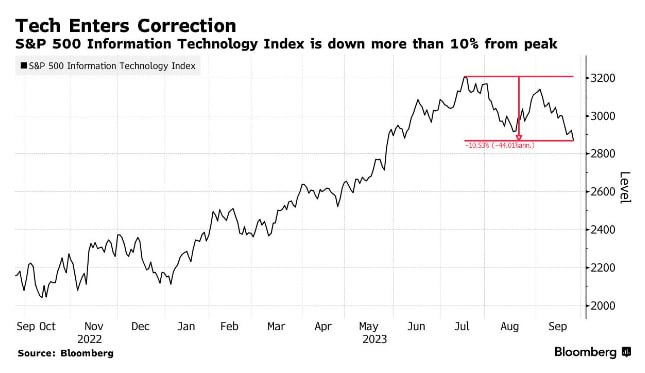

The major selloff came in the technology sector, where a strong decline sent the S&P 500 Information Technology Index down more than 10% from its July high.

Meanwhile, consumer confidence fell to a four-month low, indicating cracks in the economy’s main engine.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese