The builder at the center of China’s developer crisis said its subsidiary Hengda Real Estate Group Co. defaulted on its 4 billion yuan ($547 million) principal debt plus interest due Sept. 25.

In March, Hengda missed an interest payment on the 5.8% yuan bond issued in 2020, and said it would “actively” negotiate with bondholders to find a solution, a promise it reiterated in Monday’s statement.

Evergrande has less and less time to restart restructuring after setbacks in recent days raised the risk of a possible liquidation.

The company canceled meetings with key creditors at the last minute, faced detentions from its cash management unit and failed to meet regulator requirements to issue new bonds.

The latest item is a major blow to a planned restructuring of at least $30 billion in offshore debt that would have required creditors to swap defaulted bonds for new securities.

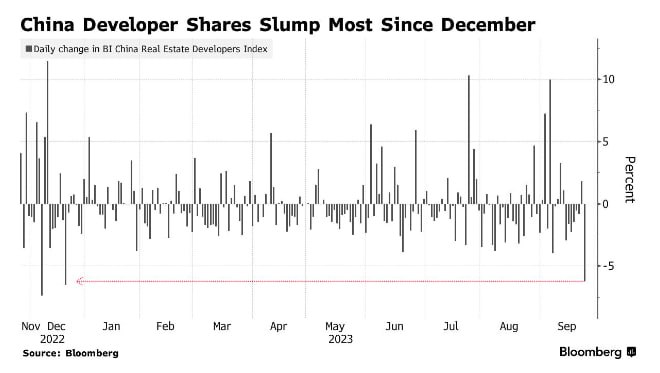

Evergrande shares fell 25% on Monday.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese