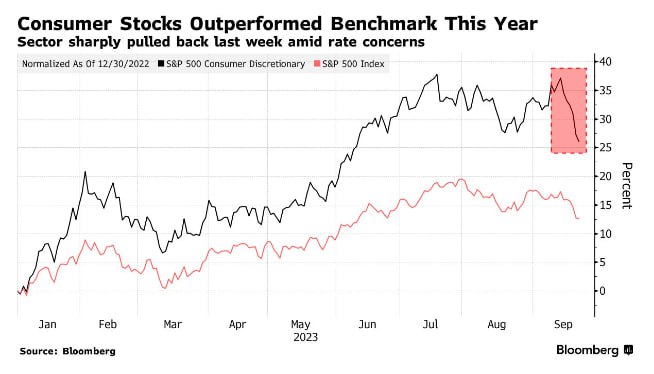

The slowing rally is consistent with Morgan Stanley economists’ view that household spending probably won’t be able to sustain the abnormal growth seen in the first three quarters, the strategist said.

Assigning equal weight to members of the consumer staples sector suggests that performance is declining, and the 44% of stocks trading below their 200-day moving average also indicate weakness, Wilson wrote in a note.

“This price action is picking up on slowing consumer spend, student loan payments resuming, rising delinquencies in certain household cohorts, higher gas prices and weakening data in the housing sector,” he said.

People are starting to see the real picture, and even Morgan Stanley can’t stay quiet about it

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese