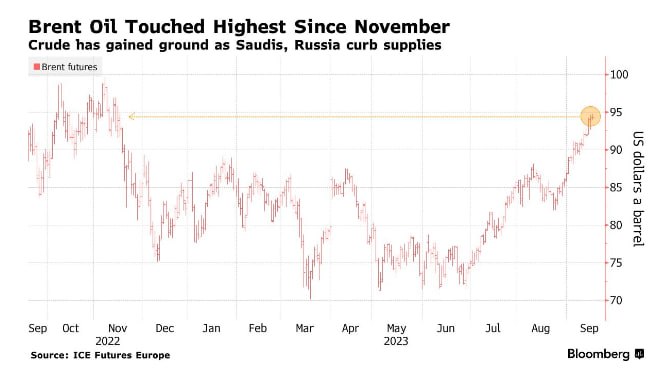

The global benchmark Brent added 0.3% after a three-week rally that saw prices rise 11%.

In recent days, the price rise has been accompanied by a jump in key timespreads, indicating a lack of supply in the market, while bullish call options are also becoming more expensive.

Rising oil prices look set to add to inflationary pressures worldwide as central bank governors, including the US Federal Reserve, try to determine whether they have already done enough to reduce the pace of price increases by raising interest rates.

This week will be crucial for monetary policy, with decisions to be made by the Fed and the Bank of England, among others.

Moreover, while Brent is appreciating, Urals is also increasing in price and confidently moving towards the $80 per barrel mark.