The general consensus is that prices will remain near current levels, but the market is “more fragile than it looks,” Ben Lacock, one of the heads of oil trading, said in an interview at APPEC (Asia’s most prestigious Oil and Energy industry conference) in Singapore.

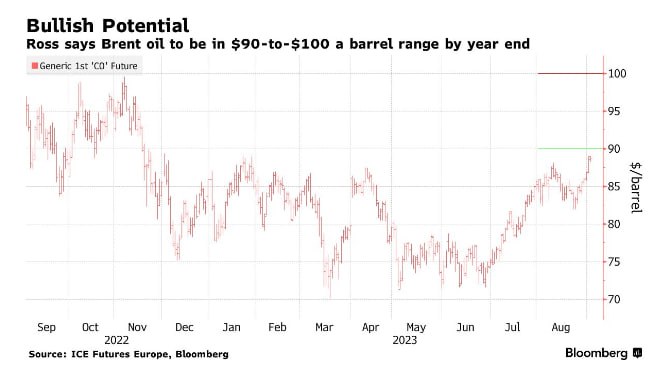

The price of Brent crude already approached $90 a barrel after OPEC+ major countries cut supply and restrictions could continue further.

Oil prices also retain upside potential thanks to booming air travel in China, according to Gary Ross, an oil consultant turned hedge fund manager at Black Gold Investors LLC.

Domestic air travel in China is already back to 110% of pre-pandemic levels, and long-distance automobile travel is still dominated by gasoline-powered cars, he said in an interview.

“You’re gonna have a big increase in jet fuel demand probably of something like 500,000 barrels a day of jet alone in China,” he said.

Brent is likely to trade in a range of between $90 and $100 by the end of the year, Ross said. It stood just below $89 on Friday.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese