The country has been shifting its investment strategy over the past few years away from keeping most of its foreign assets with the central bank as it builds up hundreds of billions of dollars in sovereign funds.

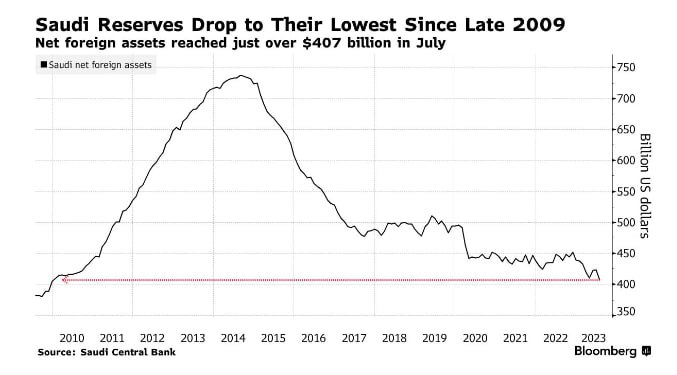

Thus, net foreign assets fell to 1.53 trillion riyals ($407 billion) after rising in May and June, the central bank said in its monthly report released on Monday.

It is the sharpest fall since the pandemic, when oil revenues plunged and the kingdom used its reserves to fund bets on rising US stocks.

Although the kingdom made huge profits last year as oil prices averaged about $100 a barrel, almost none of that went into the central bank’s reserves.

Its overseas deposits fell by about $15 billion to just over $94 billion in July.

Saudi Arabia’s finance ministry has said at least part of last year’s surplus will be used to rebuild the central bank’s reserves, but they are now about $30 billion less than they were at the start of the year.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese