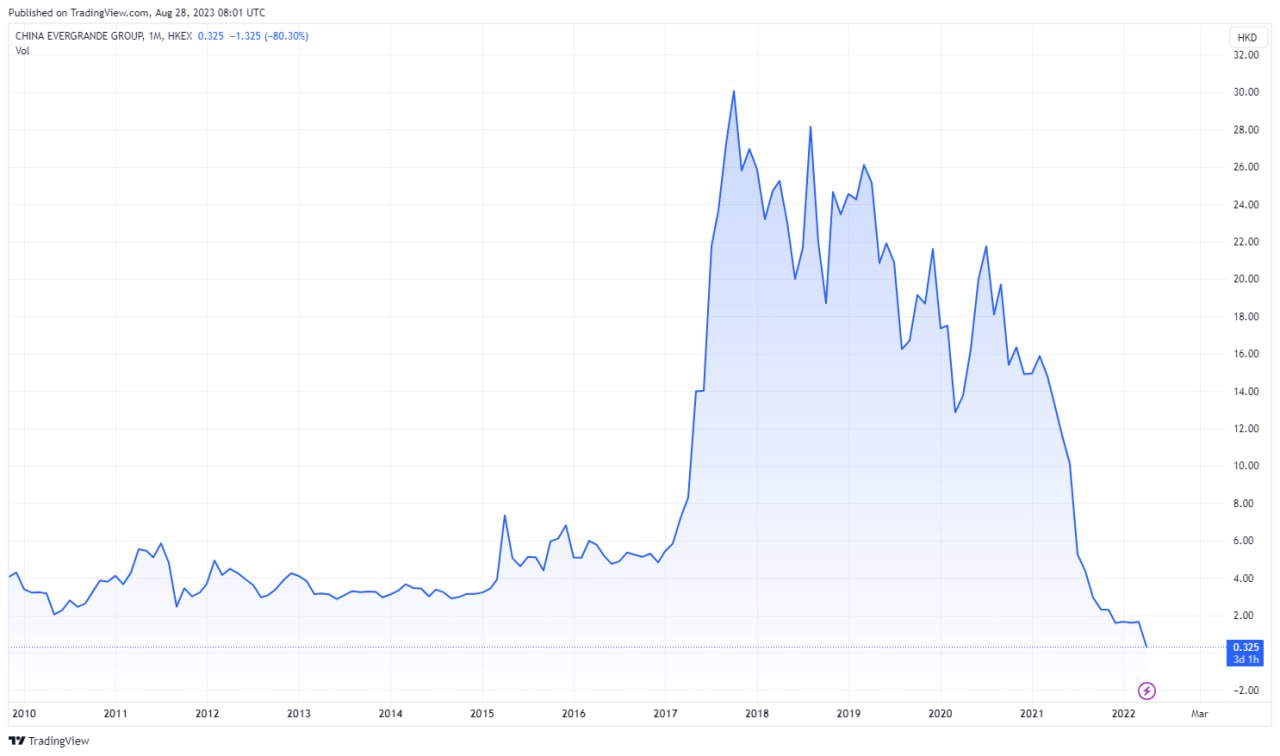

Evergrande is at the center of a crisis in China’s real estate sector, which has seen a string of defaults since late 2021 and its shares have been in limbo for 17 months. Evergrande would have faced delisting if the suspension had reached 18 months.

The developer is in the process of obtaining approvals from creditors and the courts to implement a debt restructuring plan.

Approval of the Evergrande plan requires the vote in favor of more than 75% of the holders of each class of debentures. The plan offers creditors a range of options to exchange debentures for new bonds and equity-linked instruments secured by shares in the company and its Hong Kong-registered subsidiaries.

Evergrande said its ability to continue operating will depend on the successful implementation of this offshore debt restructuring plan and successful negotiations with its remaining creditors to extend payment terms.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese