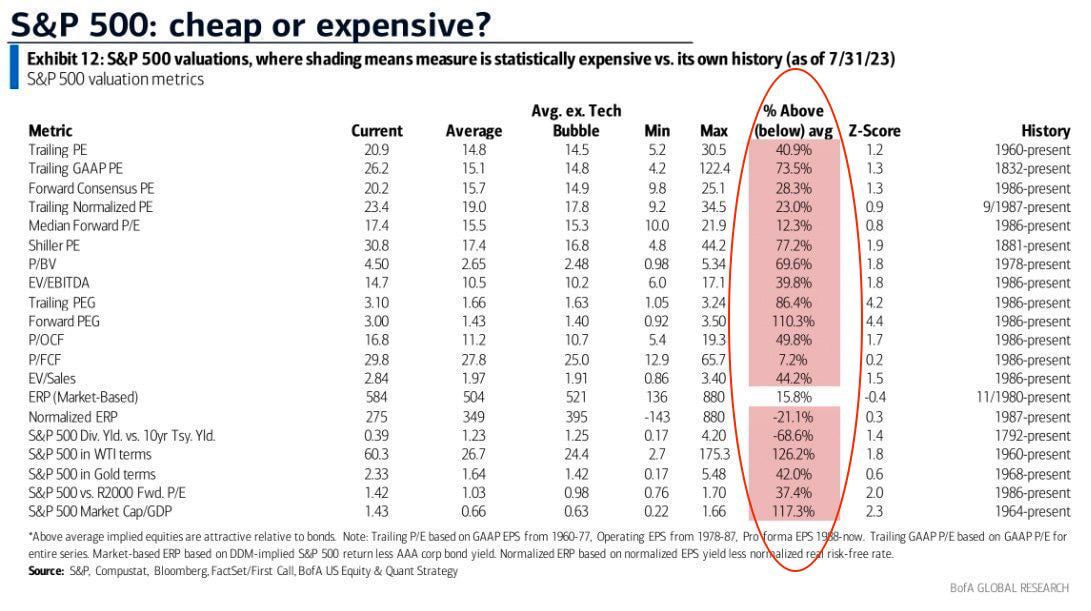

Bank of America analysts report that, according to all key metrics, the current value of S&P500 companies is higher than it should be, which is a sign of a major deep correction in companies values.

Earlier, Warren Buffett and Michael Burry also beted on a near-term decline in the US stock market.

Warren Buffett’s Berkshire Hathaway previously reported record earnings for the quarter, and showed the company’s share of cash on hand totaled $147 billion. Such amount may be needed to start picking up falling assets at lower prices immediately, should they start to fall.

As for Michael Burry – he recently put a $1.5 billion short bet against the US economy, just like he did in 2008.