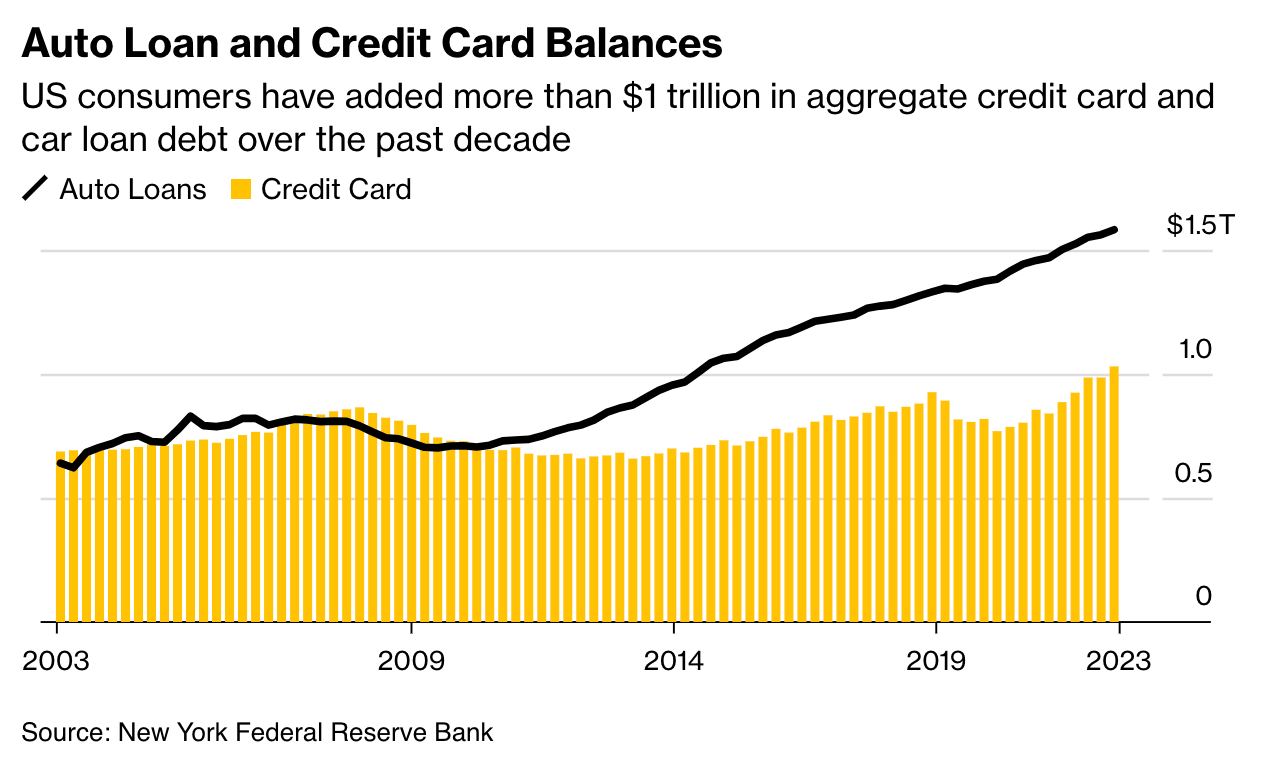

US consumers’ credit card debt has surpassed $1 trillion for the first time in history as high inflation continues to drive up costs, the New York Federal Reserve said in a report released Tuesday.

Credit card balances grew by $45 billion in 2Q2023 – rising from $986 billion at the end of Q1 to $1.03 trillion, the New York Fed data shows.

Due to inflation, higher interest rates and the high cost of living in the US, credit card debt is only expected to increase in 2023.

The average interest rate on credit card balances are at a near-record 20.53%, according to Bankrate.

Total household debt stood at $17.06 trillion by the end of Q2, the New York Fed said. Auto loan balances also rose 4.3% in Q2, climbing $20 billion.

If the labor market reveals poor data in coming months, it will likely mean that American shoppers are nearly tapped out and the country is heading inevitably towards an economic crisis.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese