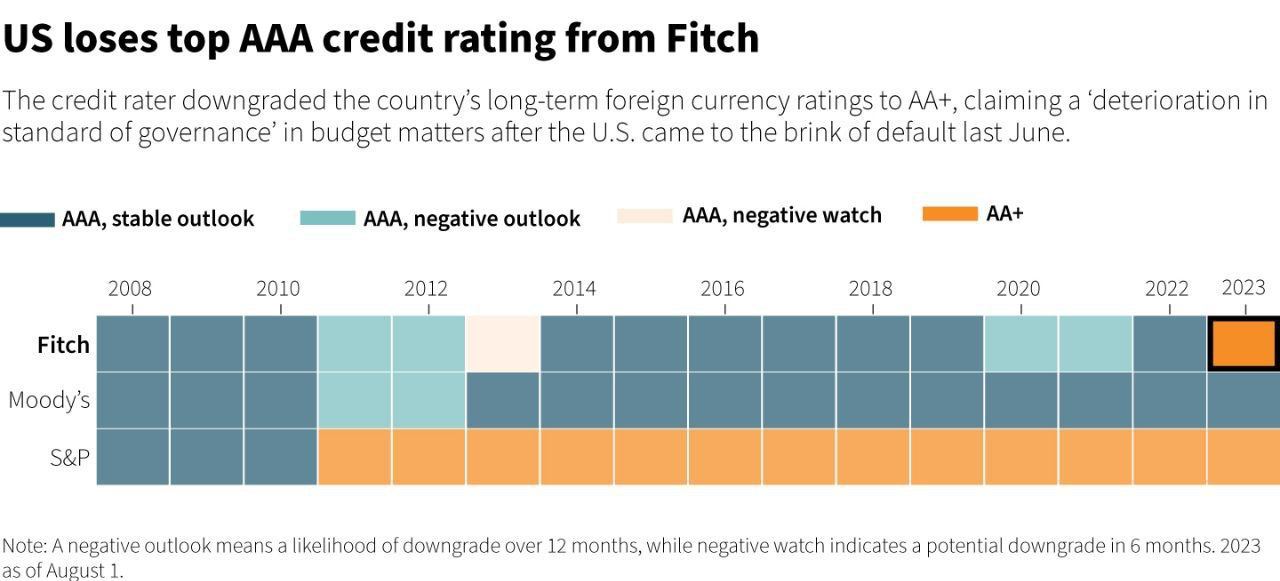

Now only one rating agency from the Big Three – Moody’s – continues to rate the US at AAA, as Standard & Poor’s downgraded the nation to AA+ back in 2011.

“The repeated debt limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” Fitch said.

Following the announcement, the dollar fell across a range of currencies, stock futures declined and Treasury futures rose. Yet some investors and analysts said they expected the impact of the downgrade to be limited.

Janet Yellen, the US Treasury Secretary, said she disagreed with Fitch’s downgrade, calling it “arbitrary and based on outdated data”.

The White House had a similar view, saying it “strongly disagrees with this decision”.

Investors use credit ratings to assess the risk profile of companies and governments when they raise financing in the debt capital markets. Generally, the lower a borrower’s rating, the higher its financing costs.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese