The move underscores the unprecedented semiconductor downturn that led the South Korean firm to post a record operating loss of $7 billion from its core chip business in the first six months of this year.

That business is expected to likely remain in the red in the current quarter, although the loss is seen almost halving to $1.7 billion from Q2.

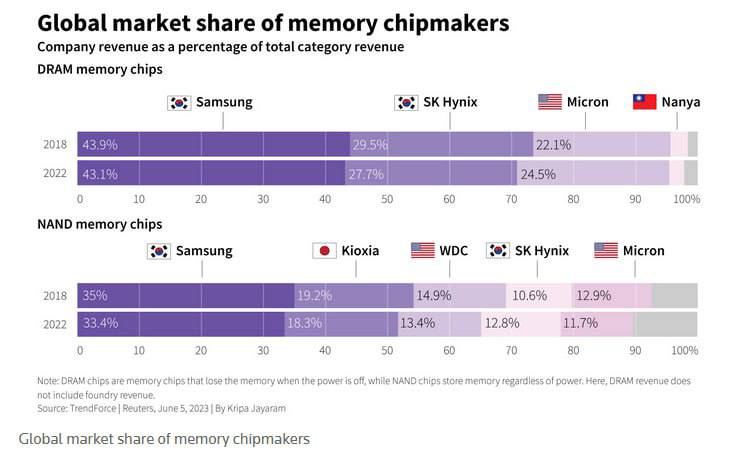

“Production cuts across the industry are likely to continue in the second half, and demand is expected to gradually recover as clients continue to destock their (chip) inventory,” Samsung, the world’s biggest memory chip maker, said in a statement.

Overall, a slowing global economy and high interest rates have dampened demand for most consumer goods since the pandemic-driven boom.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese