Credit card debt in the US grew at the fastest pace in two decades in 1Q2023.

Americans have a record amount of nearly $988 billion in credit card debt, according to Federal Reserve data released in June.

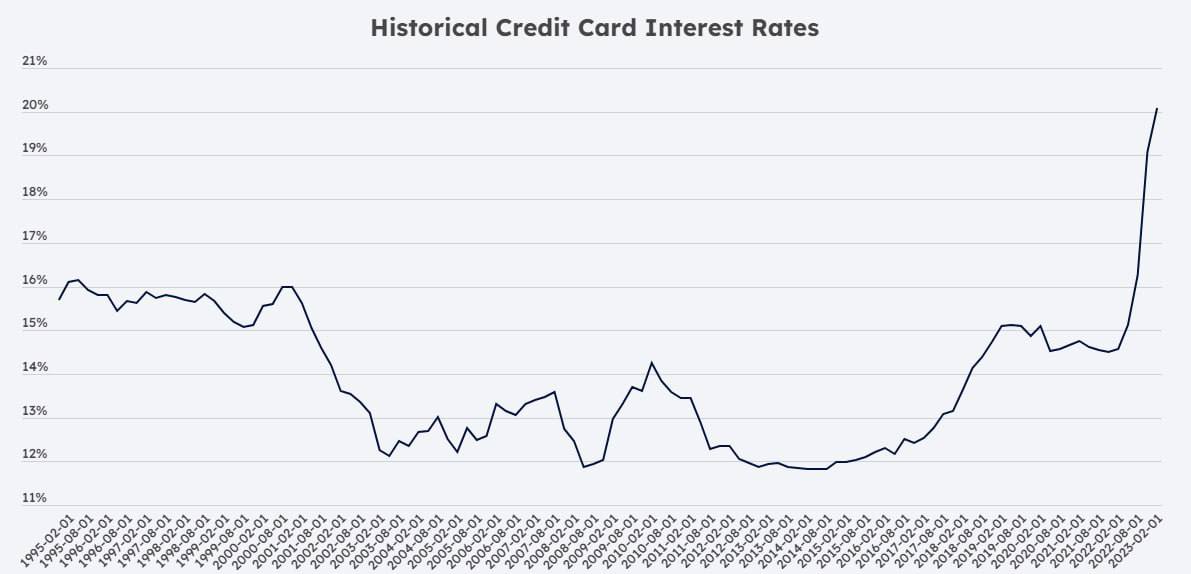

Meanwhile, the cost of handling credit card debt has continued to rise. According to the Fed, the average interest rate on new credit cards was 20.82% last week, up from just above 12% a decade ago.

That said, experts warn that debt will continue to rise.

Statistics implies that in the face of high inflation, households are not looking to optimize spending, but instead rely on credit cards to maintain their previous lifestyle, even if they can no longer afford it.

The American dream as it is