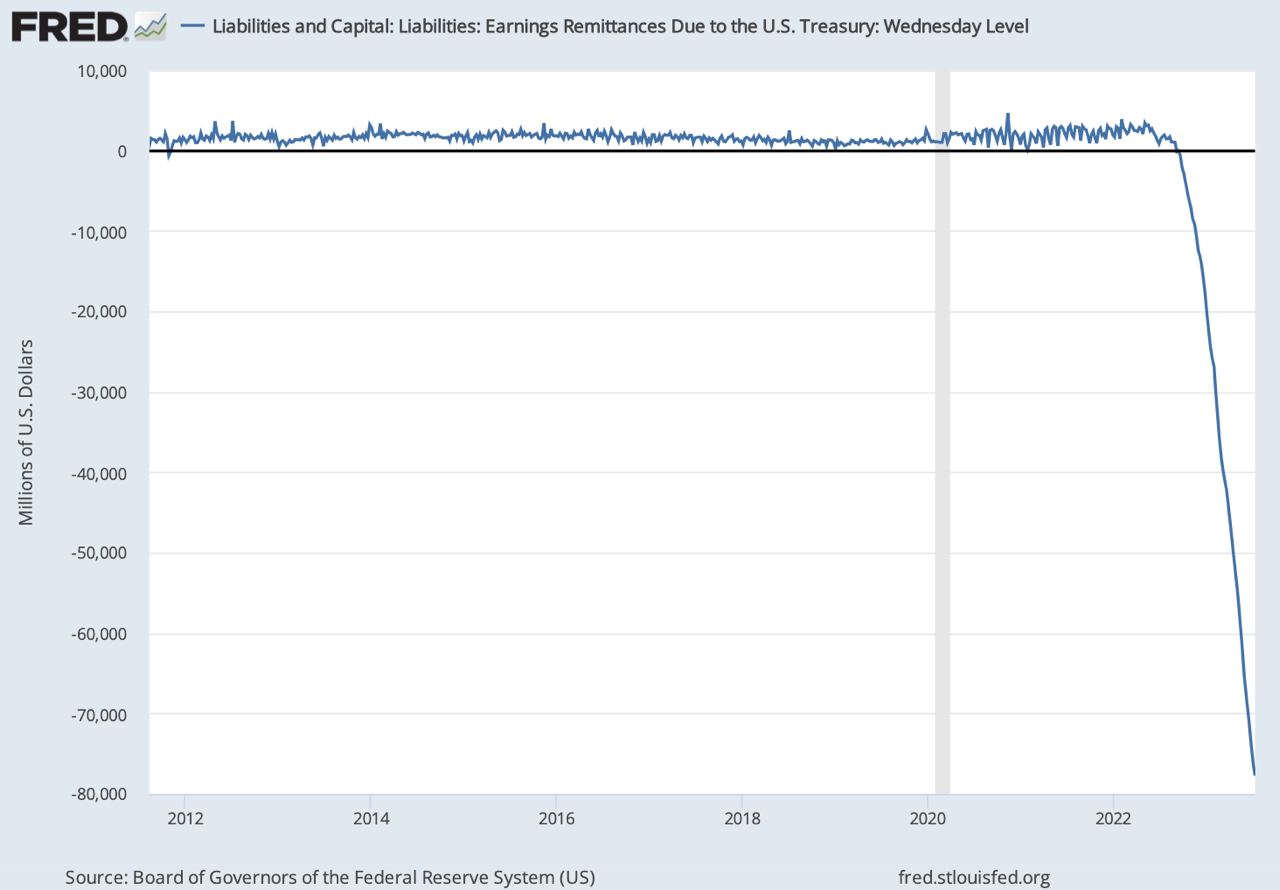

As of July 13, earnings remittances due to the US Treasury hit another record low of -$77 billion.

Simply put, this indicator shows how much the Federal Reserve owes to the US Treasury.

When the Treasury is not receiving funds from the Fed they are forced to borrow money, this leads to higher interest rates, which in turn leads to higher borrowing costs in the private sector.

The result is less capital investment, subsequently reducing economic growth – something many banks are already anticipating as seen in their earnings reports.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese