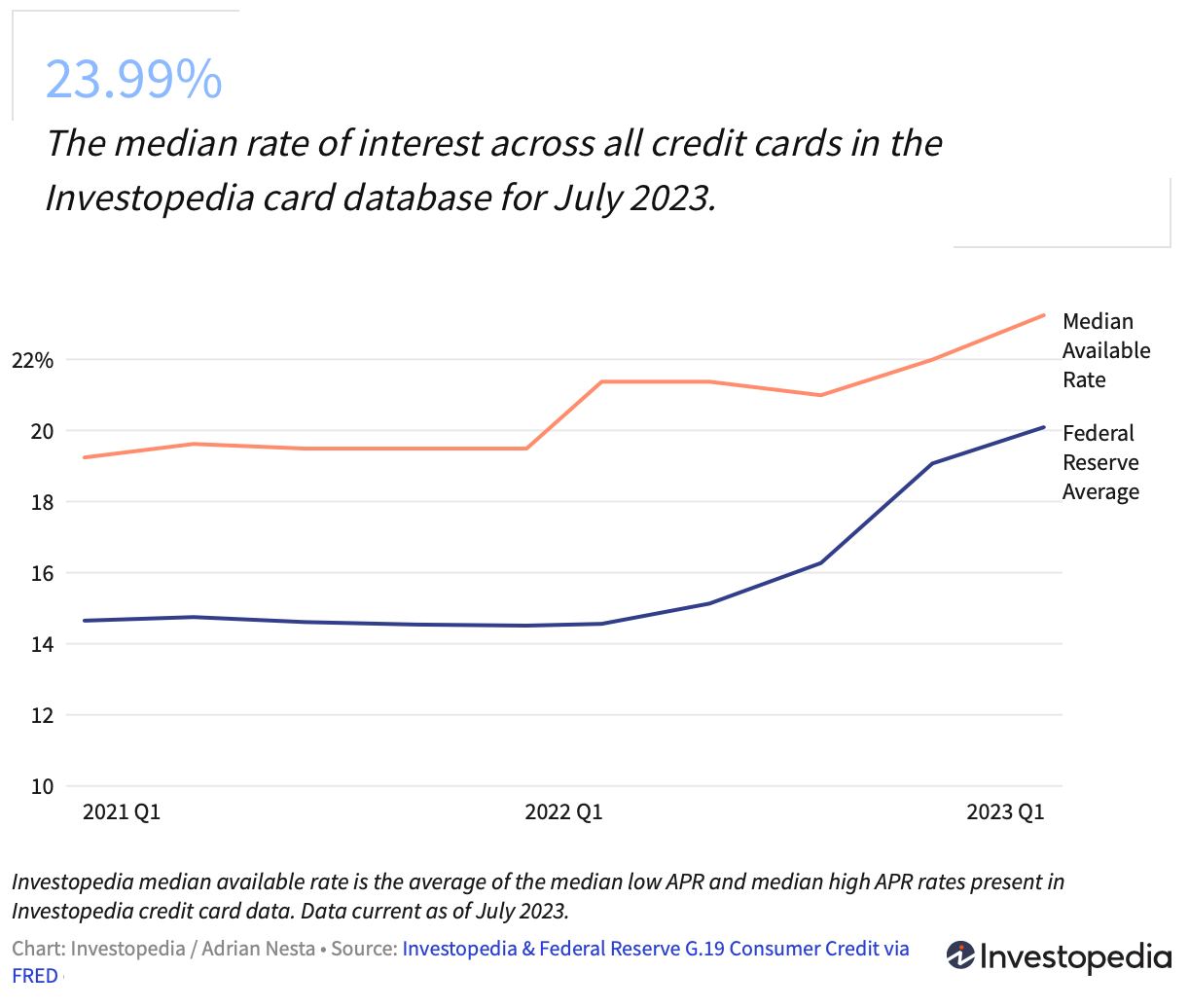

The rate increase continued even though credit card rates rose more last year than in any previous year.

With federal student loan payments set to restart in October, credit card balances pose a particularly big risk for some individuals and households.

The average credit card debt is $5,733 per person, according to TransUnion. Notably, Americans have set a record for total credit card debt with $986 billion in Q42022 – which held constant in Q12023, speaking to the challenges of high inflation and surging interest rates.

Should the US Federal Reserve continue to raise interest rates, it will make the interest on these debts even more expensive for the average American.

A credit card borrower with the average $5,733 credit card balance at only 20% will be in debt for over 17 years if they make just the minimum payments every month. They will also pay about $8,400 in interest on top of the $5,733 balance.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese