This is likely just the start of a wave of corporate defaults as companies feel the heat of decades-high interest rates and sticky inflation, with some are just filing for bankruptcy protection.

The era of “easy money” is clearly coming to an end:

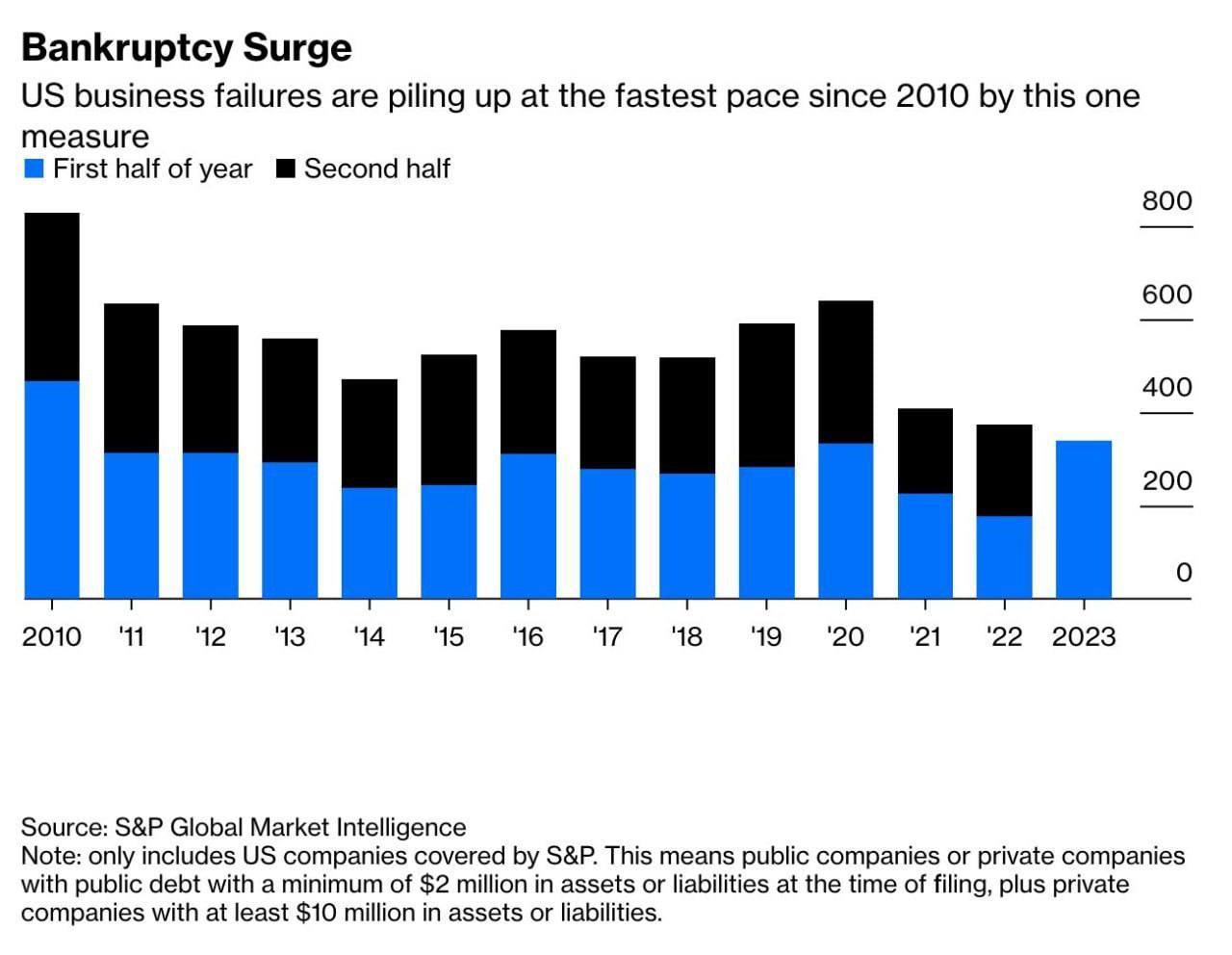

US bankruptcies in the first six months of 2023 were the highest since 2010.

In England and Wales, corporate insolvencies are near a 14-year high.

Swedish bankruptcies are the highest in a decade.

In Germany bankruptcies jumped almost 50% year-on-year in June to the highest level since 2016.

In Japan, bankruptcies are at their the highest in five years.

Insolvencies normally spike once a recession is already underway, but businesses are collapsing even as labor markets and corporate profits show surprising resilience.

Much of this is due to government financial aid programs during the pandemic and relaxation of the rules under which companies must file for bankruptcy, which in many cases postponed rather than prevented financial reckoning.

That said, analysts are unanimous that the worst is yet to come. But instead of a short and sharp shock, as happened in 2008, restructuring experts anticipate a prolonged period of corporate distress, since interest rates are likely to remain elevated for a long time as central banks try to quash inflation.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese