Last year’s plunge in financial markets led to widespread losses for sovereign money managers who are “fundamentally” rethinking their strategies on the belief that higher inflation and geopolitical tensions are here to stay.

In addition, a “substantial share” of central banks are concerned about the precedent of the West freezing nearly half of Russia’s $640 billion of gold and forex reserves, according to the survey.

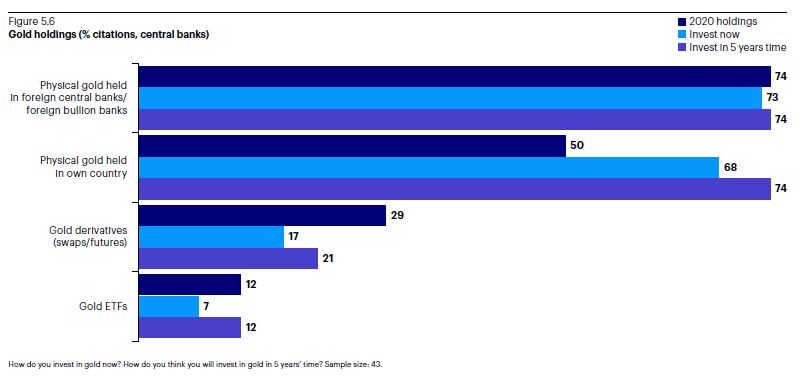

Almost 60% of respondents said it has made gold more attractive while 68% are now keeping reserves at home, up from 50% in 2020.

“We did have gold held in London, but now we’ve transferred it back to own country to hold as a safe haven asset and to keep it safe,” said one central bank, while Invesco noted that is a broadly-held view.

At the same time, central banks have begun to dump the dollar as the world’s reserve currency, with more than 7% believing that rising US debt is also a negative for the greenback.

As for investments, concerns over China mean India remains one of the most attractive countries for investment for a second year running.

Furthermore, the “near-shoring” trend, where companies build factories closer to where they sell their products, is boosting Mexico, Indonesia and Brazil.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese