◈Figure is almost double the amount banks tapped from Fed

The Federal Home Loan Bank System issued $304 billion in debt last week, according to a person familiar with the matter, who asked not to be identified discussing non-public data. That’s almost double the $165 billion that liquidity-hungry lenders tapped from the Federal Reserve.

The FHLBs are a Depression-era backstop originally created to boost mortgage lending. The system is known as the “lender of next-to-last resort” — a play on the nickname for the Federal Reserve’s discount window.

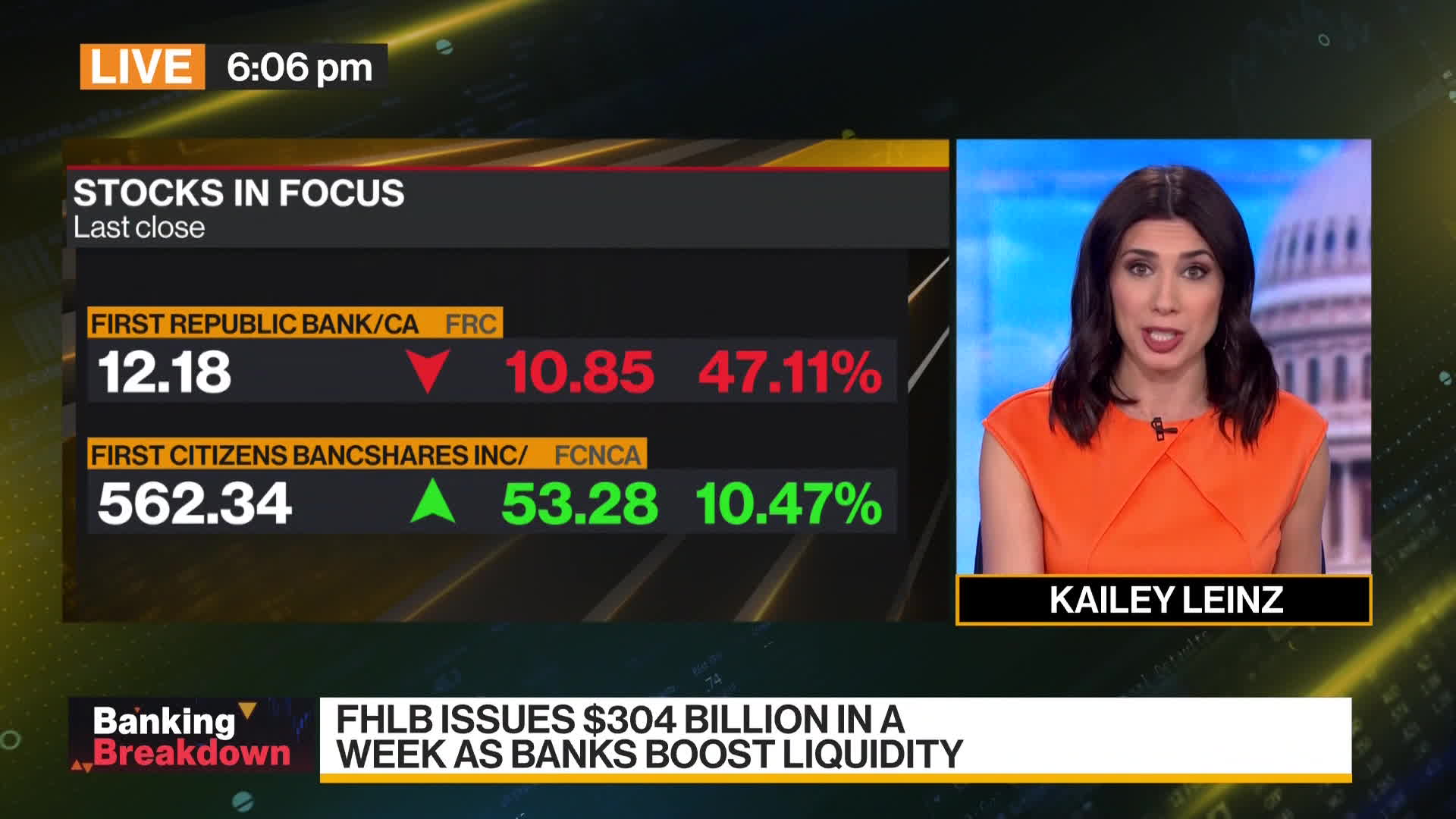

Last week’s boost in debt reflects an intense demand for cash across the US banking sector after three lenders collapsed in rapid succession amid a liquidity crunch that spurred customers to yank deposits en masse.

Total outstanding advances from the FHLBs now likely exceed $1.1 trillion, according to Barclays PLC. strategist Joseph Abate. That’s likely a record, surpassing the system’s lending during the 2008 financial crisis.

The role of FHLBs as a secondary backstop attracted scrutiny after the March 10 collapse of Silicon Valley Bank, which was the single biggest user of the Federal Home Loan Bank of San Francisco. SVB borrowed $15 billion in the fourth quarter of 2022, 17% of the San Francisco home loan bank’s lending.

Crypto bank Silvergate Capital Corp. also tapped the San Francisco FHLB before its demise earlier this month.

Wide-ranging Review

The debt issued last week included notes, which mature in less than a year, and $151 billion in longer-term bonds. The bond issuance eclipsed the nearly $55 billion supplied for the entire month of February and roughly $130 billion for January.

Total debt issued for last Monday was $112 billion, one of the biggest-ever days of financing for the FHLB system, according to the person familiar with the matter. The next day, the system issued $87 billion in notes and bonds.

“As members seek a stable source of funding in an unsettled market, the purpose of the FHLBanks has been on full display,” Ryan Donovan, president and chief executive officer of the Council of Federal Home Loan Banks, said in a March 13 statement after last Monday’s issuance.

As of the end of 2022, the 11 FHLBs in the US had $823 billion in outstanding loans, known as advances.

The FHLB System “is not intended or structured to function as a lender of last resort,” said Joshua Stallings, deputy director for bank regulation at the Federal Housing Finance Agency, the FHLB System’s regulator, in a March 13 statement.

The agency is conducting a wide-ranging review of the home loan banks. The banks were first created to free up cash for small banks to make mortgages, but have since evolved to be a short-term lender also used by Wall Street giants, including Citigroup Inc. and Wells Fargo & Co.