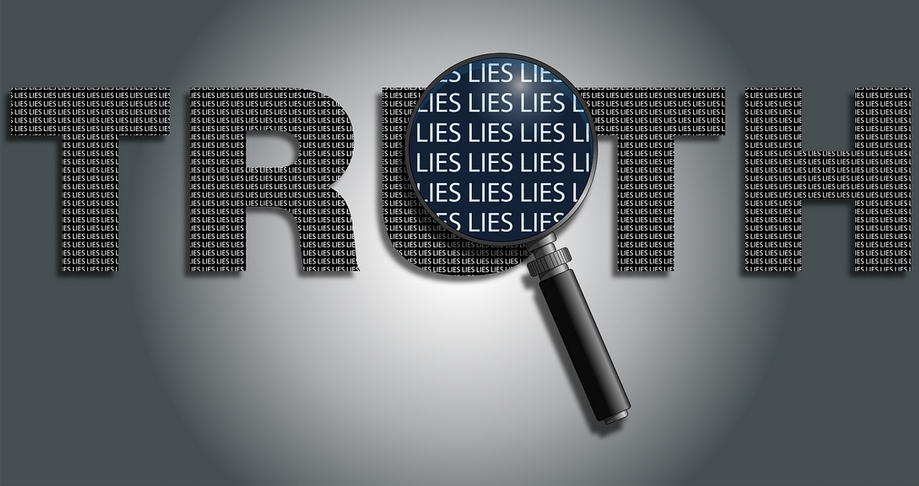

The decade-plus long efforts by the Gold Anti-trust Action Committee, whose core premise is that the prices of gold and silver have long been subject to manipulation both to provide an unfair profit advantage to certain financially institutions, but also to influence the perception of citizens at large as to the health of the U.S. Dollar and the American economy.

Growing evidence and opinion supports the idea that illegal and unethical manipulation of gold, silver, and who knows what other markets has long existed. Even CFTC Commissioner Bart Chilton has opined that, “There have been fraudulent efforts to persuade and deviously control that price,” he said in reference the silver futures market.

What has long been absent, is abundant document evidence from within the banks who are allegedly behind the price manipulation schemes. Imagine how much easier the efforts of GATA Chairman William Murphy and CFTC Chairman Gary Gensler would be if such documents were available from a source such as WikiLeaks?

One can certainly make arguments that the severity of market bubble implosions like the tech market in 2001 and real estate in 2008 are partially exacerbated by such manipulations, in that they provide an apparent foundation to support the issuance of more currency and lower interest rates to fuel leveraged speculation.

If these illegal and unethical practices can be unequivocally exposed, and thus stopped, there is no doubt that a more secure and equitable global financial system would be the result.

Gold and silver are important barometers in a financial world dominated by fiat currencies backed by nothing physical. There unfettered ability to trade freely is in the international interest, not just the national interest. Those eventually discovered to be guilty of such manipulation should be charged and tried for treason, with the appropriate sentences fully applied.

Growing evidence and opinion supports the idea that illegal and unethical manipulation of gold, silver, and who knows what other markets has long existed. Even CFTC Commissioner Bart Chilton has opined that, “There have been fraudulent efforts to persuade and deviously control that price,” he said in reference the silver futures market.

What has long been absent, is abundant document evidence from within the banks who are allegedly behind the price manipulation schemes. Imagine how much easier the efforts of GATA Chairman William Murphy and CFTC Chairman Gary Gensler would be if such documents were available from a source such as WikiLeaks?

One can certainly make arguments that the severity of market bubble implosions like the tech market in 2001 and real estate in 2008 are partially exacerbated by such manipulations, in that they provide an apparent foundation to support the issuance of more currency and lower interest rates to fuel leveraged speculation.

If these illegal and unethical practices can be unequivocally exposed, and thus stopped, there is no doubt that a more secure and equitable global financial system would be the result.

Gold and silver are important barometers in a financial world dominated by fiat currencies backed by nothing physical. There unfettered ability to trade freely is in the international interest, not just the national interest. Those eventually discovered to be guilty of such manipulation should be charged and tried for treason, with the appropriate sentences fully applied.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese