The nationwide core consumer price index (CPI), which excludes fresh food but includes energy items, rose 3.2% in May from a year earlier, beating market forecasts for a 3.1% gain.

Core consumer inflation in Japan has thus stayed above the central bank’s target of 2% for 14 straight months.

The increase has been driven by steady price hikes for food and daily necessities, suggesting that consumption has declined as the cost of living has risen.

Meanwhile, analysts expect Japanese companies to continue passing on costs for longer than expected, with risks to inflation skewed upward.

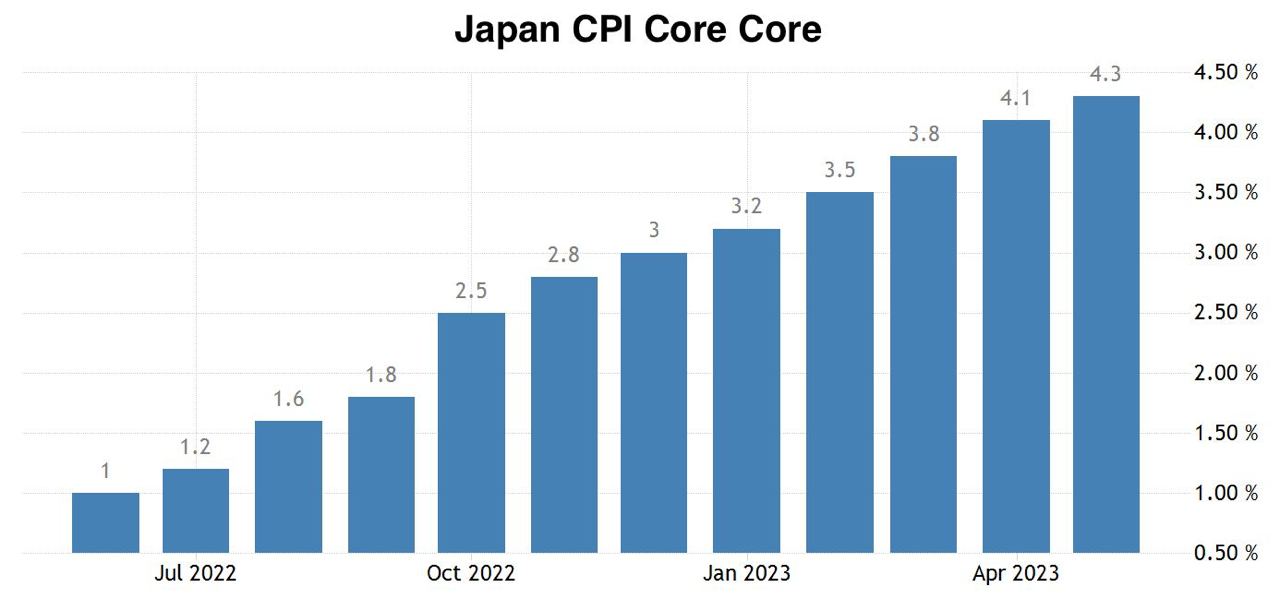

Furthermore, the Bank of Japan’s favorite “core-core” index that strips away the effects of both fresh food and fuel rose 4.3% in May, accelerating from April’s 4.1% gain and marking the biggest increase since June 1981.