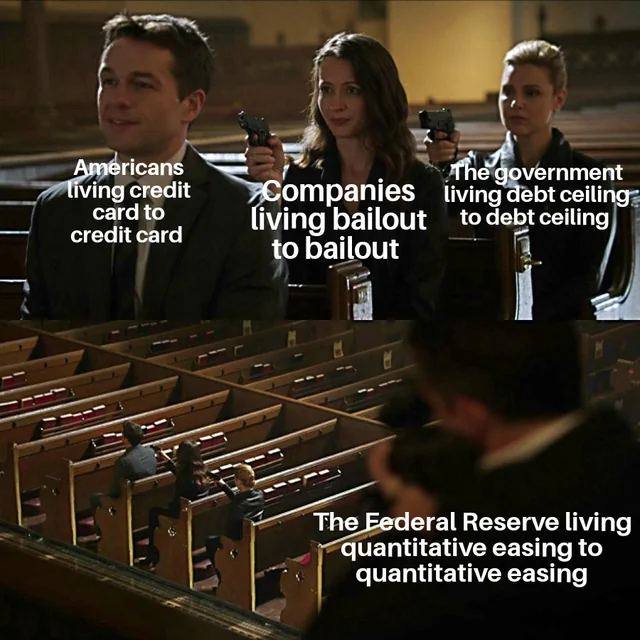

Amid high inflation in the US, many consumers have used credit to manage their budgets, resulting in a record high credit cards debt balance.

Americans on average carry around $5,733 in credit card debt, according to credit reporting agency TransUnion.

People aged 40 to 49 hold an average of about $7,600 in credit card debt – the highest of any age bracket.

“Gen Xers can be especially squeezed by credit card debt because they’re living expensive years right now,” said Ted Rossman, senior industry analyst at Bankrate.

“They might be sandwiched between caring for elderly parents and raising their own kids – maybe even putting them through college.”

Meanwhile, the youngest credit card users between the ages of 18 and 29 have about $2,900 of debt, given that most people in that age group are just beginning to use credit cards.

Additionally, not paying off your credit card bill in full each month has become more costly. Credit card interest rates are now just over 20%, compared to an average of around 16% last year, according to Bankrate’s May 31 analysis.

That is due to numerous interest rate hikes by the Fed since March 2022. Since raising rates makes borrowing money more expensive for consumers, the central bank continued to increase them in an effort to slow inflation.