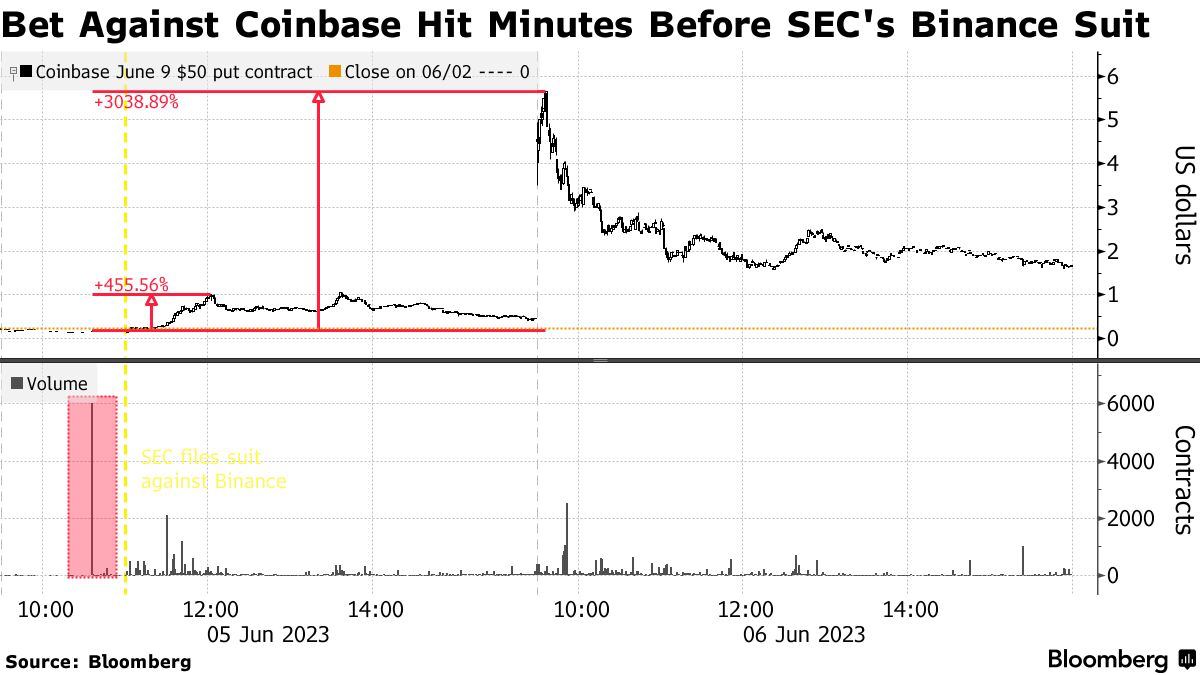

At 10:36 am on Monday, a block of 4,806 contracts of Coinbase $50 puts expiring Friday hit the tape, when the stock was at $61.77.

Roughly 24 minutes later, the SEC announced it was suing Binance, sparking a selloff across the crypto sector.

By noon in New York, Coinbase stock was down almost 12% and options that had been bought at 18 cents apiece were already traded for as much as $1 – a gain of almost 460% if sold at the peak.

The already profitable bet became even more lucrative Tuesday after the SEC announced a separate suit against Coinbase itself.

That means a trader could have potentially turned an investment of $86,500 – the sum spent on buying the puts – into a windfall of as much as $2.6 million in less than day.

Gensler hit the jackpot?