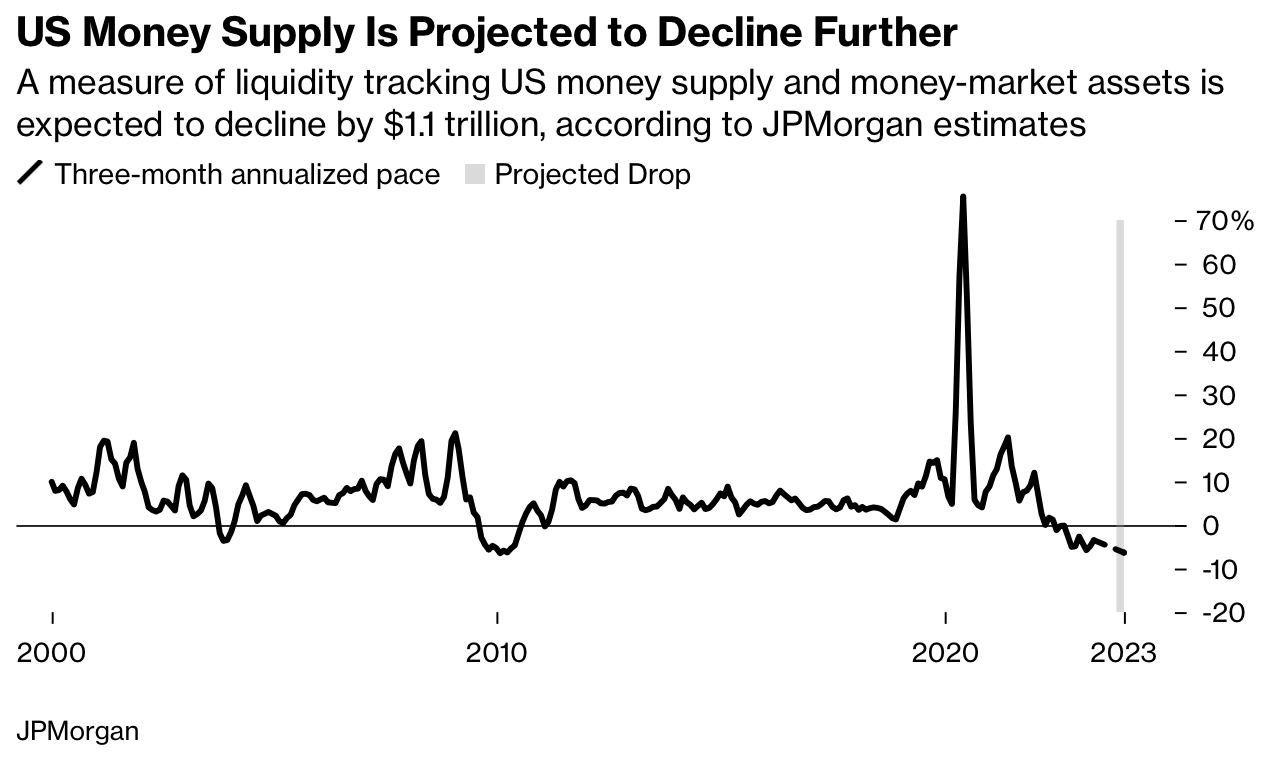

This will be yet another drain on dwindling liquidity as bank deposits are raided to pay for it, something Wall Street warns markets are not yet ready for.

JPMorgan Chase strategists estimate a flood of Treasuries will compound the effect of quantitative tightening on stocks and bonds, knocking almost 5% off their combined performance this year.

Citigroup strategists also offer a similar calculus, showing a median drop of 5.4% in the S&P 500 over two months could follow a liquidity drawdown of such magnitude, and a 37 basis-point jolt for high-yield credit spreads.

The sales, set to begin Monday, will rumble through every asset class as they claim an already shrinking supply of money.

With default averted, the Treasury will kick off a borrowing spree that by some Wall Street estimates could top $1 trillion by the end of Q3.

What will happen when those billions go through the financial system is not easy to predict, but chaos is likely to reign in the markets.

For now, relief about the US avoiding default has deflected attention from the looming liquidity aftershock. Yet as bank reserves shrink significantly, stocks are expected to fall and credit spreads widen, with riskier assets bearing the brunt of the losses.

“It’s not a good time to hold the S&P 500,” said Citigroup.

“We think there will be a grinding lower in stocks,” and no volatility explosion “because of the liquidity drain,” says Ulrich Urbahn, Berenberg’s head of multi-asset strategy.

“We have bad market internals, negative leading indicators and a drop in liquidity, which is all not supportive for stock markets.”