The survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months.

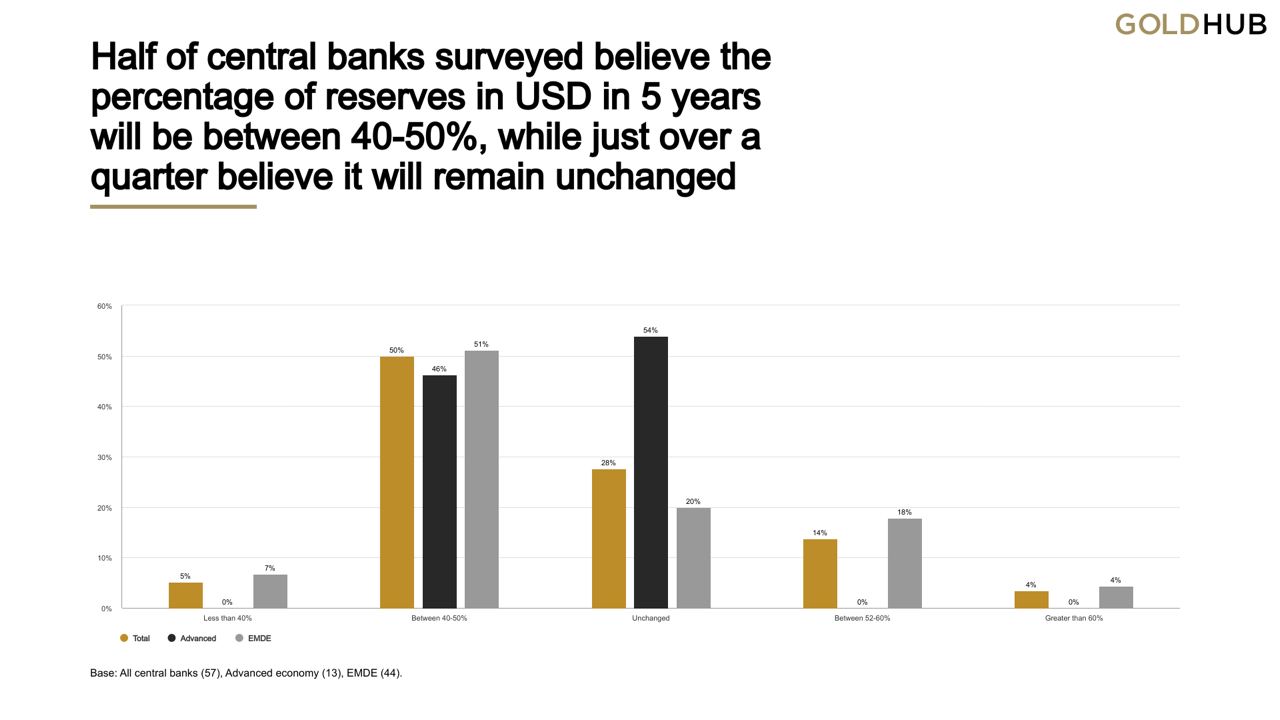

Furthermore, central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys.

By contrast, their views towards gold’s future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.

Earlier, the World Gold Council (WGC) reported that in 2022, global demand for gold increased by 18% compared to 2021, to 4,741 tons – the highest since 2011.

According to the WGC, this was mostly driven by the huge demand for gold by central banks, which in 2022 totaled 1,136 tons. This is also the highest level of gold purchases since 1967.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese