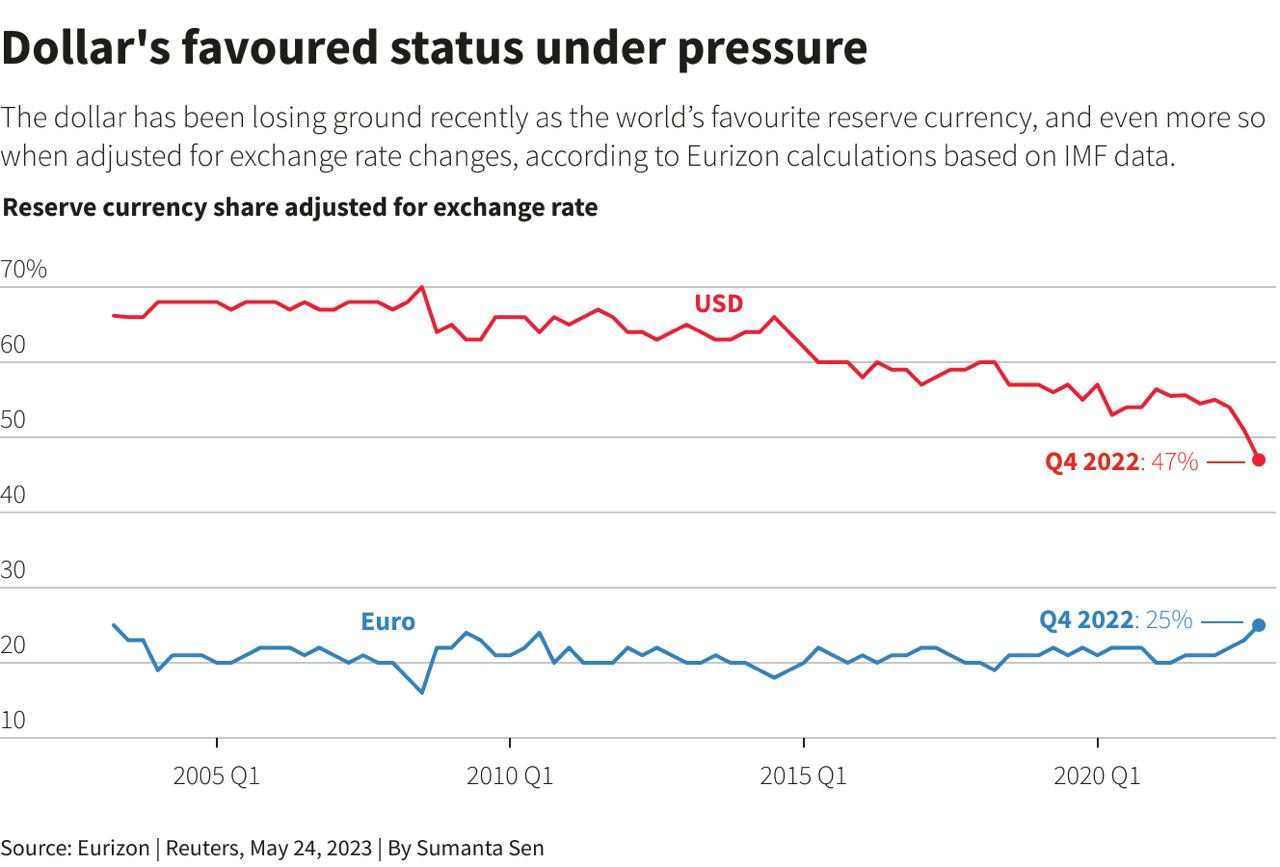

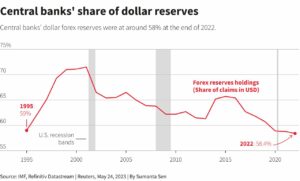

The dollar share of official FX reserves fell to a 20-year low of 58% in Q4 2022, according to the International Monetary Fund.

Analysts believe this was a reaction to the freezing of half of Russia’s $640 billion in gold and FX reserves, prompting a rethink in countries such as China, India, Saudi Arabia, and Türkiye about diversifying to other currencies.

Furthermore, trade is also shifting. India buys Russian oil in UAE dirhams and rubles. China switched to the yuan to purchase about $88 billion worth of Russian oil, coal and metals. China’s national oil company CNOOC and France’s TotalEnergies also completed their first yuan-settled LNG trade in March.

The yuan’s share of global over-the-counter forex transactions rose from almost nothing 15 years ago to 7%, according to the Bank for International Settlements (BIS).

After Russia, nations are questioning “what if you fall on the wrong side of sanctions?” analysts say.

That said, complete de-dollarization is unlikely, as the greenback is still a party to nearly 90% of global forex transactions, representing about $6.6 trillion in 2022.

Additionally, about half of all offshore debt is in dollars, with half of all global trade being invoiced in dollars too, according to the BIS.

While there may not be a single dollar successor, mushrooming alternatives could create a multipolar world, the publication concluded.

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese