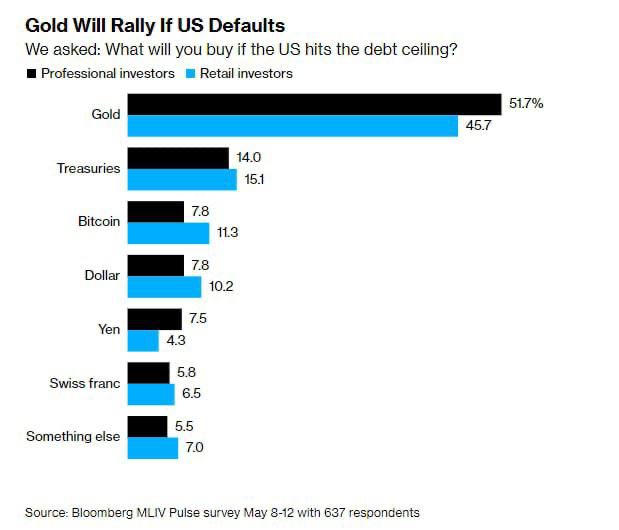

According to its survey, there’s little room for investors to take refuge except for the oldest hedge in the book: gold. More than half of financial professionals said it’s the precious metal they would buy if the US government fails to honor its obligations.

The second most popular asset to buy in case of default, as ironic as that may be, are US Treasuries. Even during the most dangerous debt crisis in previous years, Treasuries rallied and bill holders were getting paid, albeit late, according the publication.

Bitcoin has also been more popular among experts than traditional haven currencies like the Japanese yen and the Swiss franc.

As for the US dollar, 41% argue that its status as the world’s primary reserve currency is in peril, with the risk of a pivot away from the greenback being real as it is already expected to account for less than half of global reserves within a decade.

The Treasury had only $88 billion of extraordinary measures left as of May 10 to help pay the government’s bills. That means that just over a quarter of the $333 billion of authorized measures remains to keep the US government from exhausting its borrowing limit.

Treasury Secretary Janet Yellen said this month that her department could run out of cash as early as June 1, while other Wall Street forecasters remain on track for late summer projections.

Whether there will be a default or not we will likely find out on Tuesday after talks between US President Joe Biden and House Speaker Kevin McCarthy.