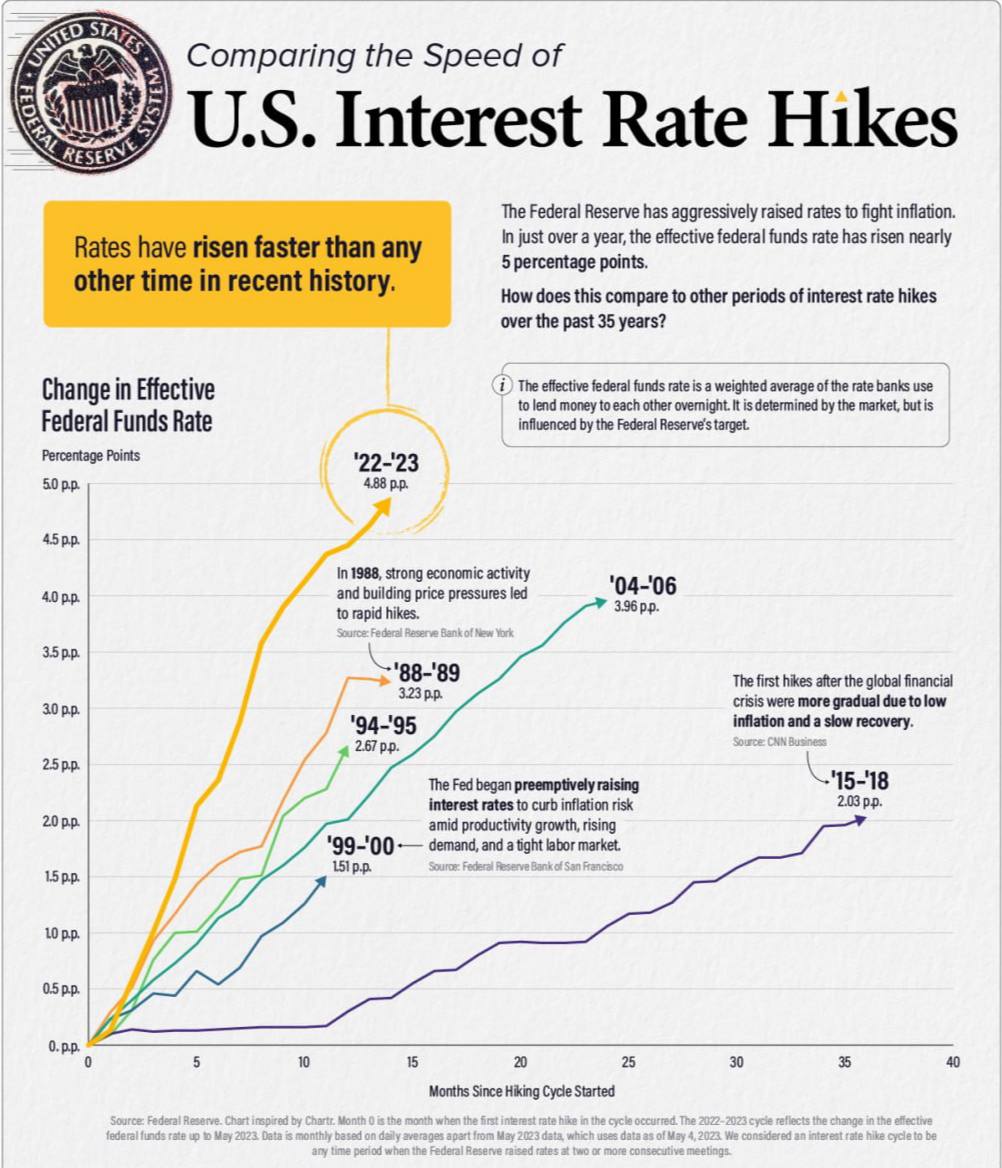

The current period of monetary tightening by the US Federal Reserve is not only the fastest, but also the most severe ever, according to a graphic by Visual Capitalist.

Such aggressive rate hikes have already led to the bankruptcies of Silvergate Bank, Silicon Valley Bank and Signature Bank in March, as well as First Republic in late April.

Yet although inflation is cooling, it is still above the Fed’s target of 2%.

Moreover, US economic growth has slowed considerably, with the central bank predicting in March the beginning of a “mild recession” later in 2023.

The Fed’s latest statement said it would “determine the extent to which additional policy firming may be appropriate,” giving a chance for a possible pause in future interest rate hikes.