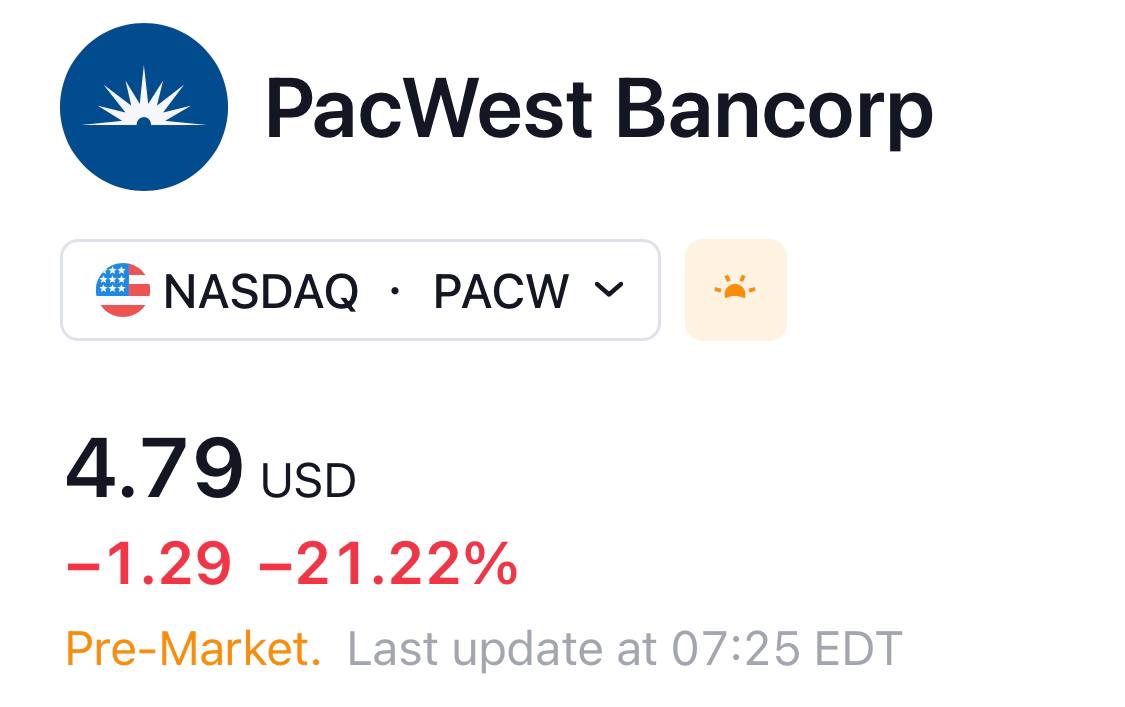

PacWest Bancorp has $15 billion of immediately available liquidity and enough resources to fund its cash flow needs over the next 12 months, it said on Thursday, but shares are still down 20% in premarket trade as investor worries persist.

So far this month, PacWest shares have lost 36%. The bank’s shares plunged to a record low last week after it said it was exploring strategic asset sales.

Wall Street executives and bank analysts have urged regulators to provide greater protection for bank deposits and consider other backstops, arguing only a strong intervention could put an end to the crisis.