10 May, 2023

Month in review

- Gold in US$/oz returned just 0.1% in April, consolidating after a strong run up during Q1

- Support for gold came from lower rates and positive ETF flows while lower inflation expectations and profit taking created a drag.

Looking forward

- The strong run-up y-t-d has left gold in need of a catalyst to break beyond its all-time high: one likely contender is a sharp equity correction, as valuations remain lofty in the face of deteriorating fundamentals

- Gold’s performance during sharp equity corrections has almost always been positive but has varied quite a bit in magnitude; prior gold returns and the level of real interest rates are key factors

- At current levels these two factors suggest gold’s response to a sharp equity sell off could sit in the upper end of the historical range.

Weaker momentum and lower yields compete

Gold rose by just 0.1% in April, to US$1,983/oz,1 as the March banking crisis – which had propelled gold sharply higher – abated and drove some profit taking (Table 1).

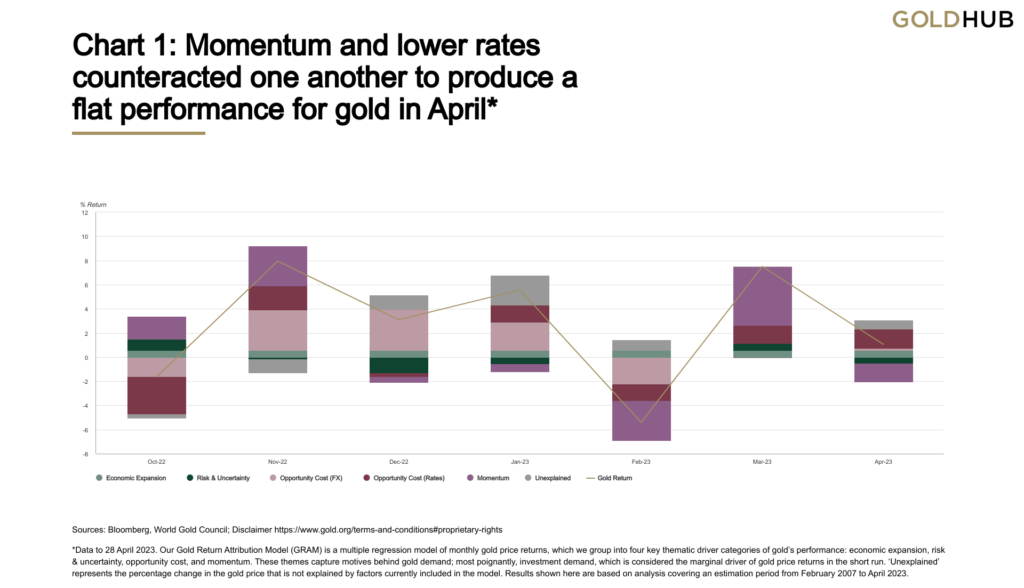

Our Gold Return Attribution Model (GRAM) indicates that April’s performance was negatively affected by the high return in March as the incipient banking crisis appeared to be well contained (Chart 1). A slight pullback in inflation expectations proved an additional drag.

In contrast, a drop in long-term Treasury yields on softer economic data provided some support and we note that another positive residual may point to continued central bank activity.

In addition, global gold ETFs experienced another month of inflows, mostly into US funds. European gold ETFs saw negligible outflows; a somewhat sanguine development given the weakness we saw for 10 months prior to March. COMEX futures followed suit, increasing longs by a modest 9 tonnes following a very strong March.

Chart 1: Momentum and lower rates counteracted one another to produce a flat performance for gold in April*

Sources: Bloomberg, World Gold Council;

*Data to 28 April 2023. Our Gold Return Attribution Model (GRAM) is a multiple regression model of monthly gold price returns, which we group into four key thematic driver categories of gold’s performance: economic expansion, risk & uncertainty, opportunity cost, and momentum. These themes capture motives behind gold demand; most poignantly, investment demand, which is considered the marginal driver of gold price returns in the short run. ‘Unexplained’ represents the percentage change in the gold price that is not explained by factors currently included in the model. Results shown here are based on analysis covering an estimation period from February 2007 to April 2023.

Table 1: Gold returns were mixed in April, consolidating just below all-time highs in US dollars

Gold price and return in different periods across key currencies*

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | AUD (oz) | |

| 28 April 2023 price | 1,983 | 1,799 | 8,688 | 1,578 | 2,687 | 1,774 | 52,161 | 441 | 38,564 | 2,997 |

| April return | 0.1% | -1.5% | 2.7% | -1.7% | 0.4% | -2.1% | -0.3% | 0.8% | 1.6% | 1.2% |

| Y-t-d Return | 9.3% | 6.2% | 13.6% | 5.1% | 9.3% | 5.8% | 8.1% | 9.6% | 13.6% | 12.6% |

*Data to 28 April 2023. Based on the LBMA Gold Price PM in local currencies.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Gradually… then suddenly

- Equities continue to grind higher even as recession risks mount; one of the tailwinds, excess savings, may be nearing depletion

- Historically, gold has gone up during most sharp equity sell offs but the magnitude varies: gold’s performance leading up to the sell off and the prevailing level of real yields appear to be key

- At current levels, these two factors suggest gold’s response to a sharp equity sell off could be at the higher end of the historical range.

Equity markets are not the economy. But they are closely linked to it and stocks are a crucial investor sentiment barometer. If we go by their recent performance and valuations, sentiment seems pretty positive.

Yet, bonds and commodities appear to disagree. These assets have been signalling a recession or thereabouts since around mid-2022: bonds via a yield curve inversion and commodities via a lacklustre response to supply issues.2 Economists are increasingly of the same view: those from The Wall Street Journal see a 61% probability of a recession this year;3 Bloomberg’s economists put the probability at 65%;4 and the survey of Professional Forecasters predicts a 40% chance. Before you say: ‘40% is low’, consider that it is substantially higher than it was at the onset of the last five recessions.

Why are equities the lone wolf? There are a number of candidates to provide an explanation:

- Growth and employment is holding up despite soft data pointing to a sharp slowdown

- The Fed has been adding liquidity to the system and a ceiling for rates is on the horizon

- Equity margins remain close to record levels

- April is a seasonally strong month for equities.5

Chart 2: Is a major contributor to economic strength about to disappear?

Sources: Bloomberg, World Gold Council;

Excess savings estimated as cumulative savings relative to the pre-COVID trend (Jan 2017- Feb 2020). Light green dashed line forecast is a simple linear extrapolation using the last six months of data.

An important piece of the puzzle that made the rounds last year was an estimate of the excess savings accumulated since COVID lockdowns in 2020 (Chart 2). Initially calculated by the Fed and since updated by various banks and commentators, it is likely this excess capital has been a major contributor both to demand-pull inflation and to corporate margins reaching record levels.6

But there is concern that those excess savings might soon be depleted. And when savings are insufficient – particularly in a world of high prices – spending might have to be reined in or supplemented by credit.

US credit card debt has skyrocketed in the last year7 but higher interest rates have made that debt increasingly expensive or, in recent months, unobtainable, as lending standards have tightened.8 But while unemployment remains low, these issues are not insurmountable. The problem lies in the fact that these things can drag one another down simultaneously: lower spending = > lower revenues = > narrower margins = > higher unemployment = > higher delinquencies and lower spending… and so on.

“How did you go bankrupt? Two ways: gradually and then suddenly.”

The Sun Also Rises, Ernest Hemingway

Things move swiftly in markets and being hedged prior to an event is prudent.

Last month we mentioned how the VIX index has seemingly been asleep on the job. At the end of April, the Chicago Board Options Exchange (CBOE) launched a new index – VIX1D – to better reflect risk sentiment in the market, as hedging might have shifted from longer-dated options to shorter-dated ones.9 But even in this new index, hedging activity remains muted with implied volatility at low levels, exposing markets to a potentially violent turn.

In the meantime, gold continues to be supported by central bank buying, a reopening in China, geopolitical skirmishes and a quiet revival in gold ETF and OTC demand. But absent a strong catalyst, one can’t rule out short-term pressures including an analogue with the 2011 peak, a bounce in the US dollar, and abating banking fears promoting further profit taking.

Would a big equity fall be a strong catalyst? Core to our strategic case for gold is gold’s performance during crises, particularly when those crises cause a material hit to risk assets. But while gold’s response in these crises is almost always positive, it varies in magnitude. This could be due to several factors, some of which may constrain gold’s response, and some which may enhance it.

Understandably, the trajectory of the US dollar and real rates during the quarter in which equities fall have a bearing on how gold responds. Q2 2022 was a quarter in which gold fell alongside equities, as the twin headwinds of rates and the dollar outweighed gold’s risk response. But are there indicators prior to the fall that can help determine how gold reacts?

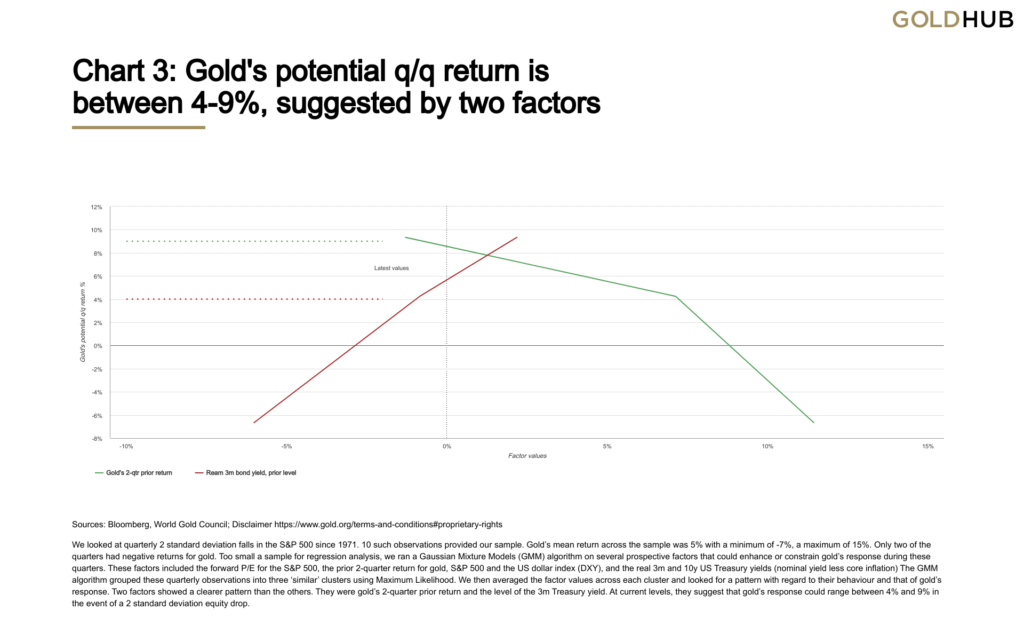

We looked at a proposed set of such indicators and found two candidates: the prevailing 3m real rate level and gold’s return in the two prior quarters. Historically, a higher preceding real rate has been associated with a stronger gold response. Likewise, a weaker preceding performance from gold has helped enhance gold’s response (Chart 3).

This stands to reason. A strong run up in gold prices might be subject to some exhaustion prior to an equity sell off.

Chart 3: Gold’s potential q/q return is between 4-9%, suggested by two factors

Sources: Bloomberg, World Gold Council;

We looked at quarterly 2 standard deviation falls in the S&P 500 since 1971. 10 such observations provided our sample. Gold’s mean return across the sample was 5% with a minimum of -7%, a maximum of 15%. Only two of the quarters had negative returns for gold. Too small a sample for regression analysis, we ran a Gaussian Mixture Models (GMM) algorithm on several prospective factors that could enhance or constrain gold’s response during these quarters. These factors included the forward P/E for the S&P 500, the prior 2-quarter return for gold, S&P 500 and the US dollar index (DXY), and the real 3m and 10y US Treasury yields (nominal yield less core inflation) The GMM algorithm grouped these quarterly observations into three ‘similar’ clusters using Maximum Likelihood. We then averaged the factor values across each cluster and looked for a pattern with regard to their behaviour and that of gold’s response. Two factors showed a clearer pattern than the others. They were gold’s 2-quarter prior return and the level of the 3m Treasury yield. At current levels, they suggest that gold’s response could range between 4% and 9% in the event of a 2 standard deviation equity drop.

And conversely, a weak run up probably goes hand in hand with a higher prevailing real interest rate, as both a driver of lower preceding gold returns and a stronger platform for yields to respond.

Summary

As equity indices grind higher, risk-on sentiment remains. Both tight credit spreads and low implied volatility measures reflect this. Gold is tiptoeing around all-time highs but may need a catalyst to break beyond current levels. The anticipated ’25bps and pause’ FOMC policy statement proved not to be a catalyst while strong employment data on 5 April undermined near-term policy support.

An equity sell-off, however, could be that catalyst. Excess savings, accumulated through lower spending and large fiscal transfers since 2020, look to be dwindling. While these savings have been a possible driver of both high inflation and strong margins for equities, their potential depletion could also be equities’ undoing. Should that transpire, gold has a history of responding well to sharp equity sell offs. But the extent of that response varies. We find that alongside a decent fall in real yields and the US dollar, the prior level of real yields and gold’s performance leading up to the equity sell off also have some sway. As it currently stands, these two factors historically point to a good rather than a poor response to an equity sell off.

Regional insights

China: Au9999’s daily trading volume averaged 13.6t in April, 3% higher m-o-m. Softer local gold price rises in the month and the industry’s preparation for the anticipated sales boom during the five-day Labour Day Holiday between 29 April and 3 May contributed. Nonetheless, Au9999’s average daily volume remained well below its five-year average. The Shanghai-London gold price spread fell sharply – elevated gold imports in recent months and only modest improvement in demand may have further eased local supply and demand conditions, weighing on the local premium.

India: Early indications from our data partner, Metals Focus, suggest that gold sales during Akshaya Tritiya were not as bad as feared. High gold prices hampered gold demand during Q1 and expectations were for subdued festival sales in April. This could indicate that Indian consumers are becoming acclimatised to the higher price level, although we remain cautious on the demand outlook.

Europe: The European economy has, so far at least, performed better than expected. But growth appears uneven and core inflation stubborn despite headline inflation dropping to 6.9% in March, down from 8.5% in February. Concerns over inflation remain a drag on local equities and the market is expecting the ECB to respond with further rate rises. Gold ETF data for April suggests that these factors have impacted interest in gold within the region.

US: The economic growth picture in the US continues to be mixed. Both manufacturing and non-manufacturing Purchasing Managers Index (PMI) surveys continued to decline, with the latter below the 50 threshold and the former just above it. In addition, renewed turmoil in the banking industry heightened fears of a slowdown and possible recession.

On the inflation front, annual headline inflation cooled to 4.2% but annual core inflation remains high at 4.6%, as core services inflation eased but core goods inflation returned.

Central banks: According to IMF reported data, global central bank gold reserves remained virtually unchanged in March (+0.2t). Purchases by China (18t) and Singapore (17t) helped offset heavy sales from Turkey (15t), Uzbekistan (11t) and Kazakhstan (10t) during the month. Russia also showed a three tonne fall in official gold reserves in March after submitting previously unreported information dating back to February 2022. For more, please see our Gold Demand Trends Q1 report.

ETFs: Global gold ETFs saw another inflow in April: net inflows totalled US$824mn while holdings increased 15t. The global total of gold ETF total assets under management rose 1% to US$221bn by the end of April. Gold holdings were 15t higher at 3,459t. North America led global inflows while demand for European funds turned negative again (Table 2). Meanwhile, funds in Asia and the Other region saw modest inflows.

Despite recent inflows, global gold ETF flows during the first four months of 2023 remained negative at US$654mn, equivalent to a 13t decrease in holdings, due mainly to losses from European funds (-US$2.6bn, -41t).

Table 2: Global gold ETF inflows continued in April

Gold ETF holdings and flows by region*

| Total AUM (bn) | Fund Flows (US$mn) | Holdings (tonnes) | Demand (tonnes) | Demand (% of holdings) | |

| North America | 111.7 | 984.3 | 1,752.5 | 15 | 0.87% |

| Europe | 97.2 | -222.8 | 1,525.1 | -0.7 | -0.05% |

| Asia | 7.9 | 13.6 | 118.1 | 0.1 | 0.11% |

| Other | 4 | 48.5 | 63.4 | 0.8 | 1.26% |

| Total | 220.9 | 823.5 | 3,459.0 | 15.2 | 0.44% |

| Global inflows / Positive Demand | 3332.6 | 30.2 | 1.52% | ||

| Global outflows / Negative Demand | -2509.0 | -14.9 | -1.14% |

*Data to 30 April 2023. On Goldhub, see: Gold-backed ETF flows.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

footnotes

- Based on the LBMA Gold Price PM in US$ as of 28 April 2023.

- Commodity prices have been falling for almost 12 months, despite 50% of BCOM commodity futures curves remaining in backwardation (a sign of supply constraint), considerably higher than the 2008-2020 average of c.25%.

- Wall Street Journal

- Bloomberg

- Yardeni Research

- Profit per unit of gross value added is at levels (c.15%) not seen since the 1950s. The average between 1947 and 2023 is 9%. Source: FRED, World Gold Council

- Revolving consumer credit rose 15% y/y in February, an increase not seen since 1996. See Federal Reserve

- Net % of domestic respondents tightening standards on consumer credit card loans is at 28.3 vs an average of 7.4 since 1991. See FRED

- CBOE

Japanese

Japanese English

English French

French Hindi

Hindi Korean

Korean Arabic

Arabic Portuguese

Portuguese