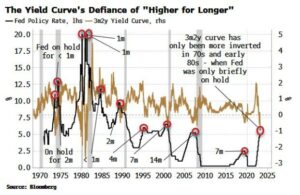

The Federal Reserve will be unable to keep rates at their peak for long, according to the clear message coming from the front part of the yield curve. Nonetheless, the end of Fed tightening cycles tend to be positive for both stocks and bonds, with stocks outperforming.

This week the Fed is likely to raise rates to their highest level, 5.25%, in more than 15 years. This is a significant milestone as it is the highest cycle-peak in rates the Fed has been able to maintain for the longest time – 14 months in 2006-2007. The burning question is: will it be able to repeat this feat, or even come close to it?

The market’s answer is a resounding no. But before we see why, note that the 2006-2007 period was very much the exception, not the rule. The Fed is rarely able to keep rates at their peak for long, looking at tightening cycles going back to 1972. In the cycles after 1990, though, the average period on hold is longer — about four to five months — than cycles pre-1990, when it averaged less than a month.

Authored by Simon White, Bloomberg macro strategist,